X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Source: TechFlow (Shenchao)

X has shut down “tweet-to-earn.”

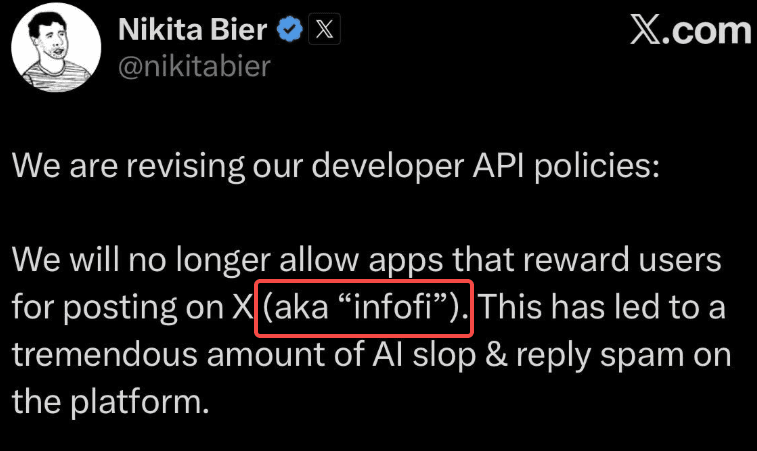

Yesterday, X’s Head of Product Nikita Bier announced that any application that rewards users for posting will have its API access revoked.

He added—almost considerately—that affected developers are welcome to contact the team, and X will help them migrate to Threads or Bluesky.

“The landlord kicks you out—and even helps arrange the moving truck.”

As soon as the news broke, the InfoFi sector collapsed across the board. KAITO fell by 20%, Cookie dropped by 20%, and the Kaito Yappers community, with 157,000 members, was shut down entirely.

Less than an hour later, Kaito founder Yu Hu published a long-form statement.

The post contained no apology to the community and no protest against X’s policy change. Its core message was straightforward:

Move elsewhere.

Yaps is being discontinued. The new product is called Kaito Studio, which will follow a more traditional marketing model—one-to-one partnerships between brands and creators—moving away from the open, points-farming system where anyone could participate.

Twitter is no longer the priority. The focus will shift to YouTube and TikTok.

The crypto niche is no longer the sole target either; the expansion is toward finance, AI, and the broader creator economy—a market worth USD 200 billion.

The product is ready.

The direction is clear.

The data is in place.

And a new narrative has been formed.

Still, this does not feel like an emergency response written within an hour. It feels more like something prepared in advance—kept in a drawer, waiting for X to make the first move.

At the same time, there were earlier signals on-chain.

Kaito’s multisig contract previously distributed 24 million KAITO tokens to five addresses. One of those addresses transferred 5 million KAITO in full to Binance a week ago.

It looks far more like a cash-out at the right moment.

Advance communication.

Advance drafting.

Advance transfer of tokens to exchanges.

Everything that needed to be done was done.

Then, once X made the announcement, the long statement followed immediately—polished, composed, framed as a proactive pivot and an embrace of change.

In the statement, Yu Hu wrote:

“After discussions with X, both parties agreed that a fully permissionless distribution system is no longer viable.”

Agreed.

Being kicked out is reframed as “reaching consensus.”

A product being effectively terminated is repackaged as a strategic upgrade.

This kind of rhetoric is all too familiar in crypto.

Projects never say, “We failed.”

They say they are exploring new possibilities.

They say market conditions have changed.

They say this is a planned transition.

It sounds graceful—but it is also pure PR.

At its core, X’s ban was merely the final blow. The “tweet-to-earn” model was already on its way out.

Mining by posting sounds appealing: tokenizing attention, fairly compensating creators, building a decentralized information economy.

But once deployed in reality, everyone knows how it played out.

If rewards are tied to posting, people post more.

If AI can generate content at scale, AI does the posting.

If accounts are unlimited, people spin up endless alts.

According to CryptoQuant, on January 9 alone, bots generated 7.75 million crypto-related tweets on X, a year-over-year increase of 1,224%.

ZachXBT had already been criticizing this last year, calling InfoFi platforms the primary drivers of AI-generated spam. He even offered a USD 5,000 bounty for user data to identify bot networks.

Genuine discussion was drowned out by endless “GM,” “LFG,” and “bullish.” Humans and bots blended together to the point where telling them apart became nearly impossible.

X’s Head of Product, Nikita Bier, had already posted a warning last week:

“CT is dying from suicide, not from the algorithm.”

Crypto Twitter is killing itself—it isn’t being killed by the algorithm.

At the time, the crypto community mocked him for arrogance and responded with GM memes.

Looking back now, doesn’t it feel like a notice issued before an execution?

Addressing spam, Yu Hu said Kaito had tried everything: raising thresholds, adding filters, redesigning incentives.

None of it worked.

The moment you reward posting with tokens, you are effectively offering a bounty for noise. No threshold can outpace profit-driven behavior. Human incentives are straightforward: as long as rewards exist, spam will not stop.

More critically, the lifeline was never in their own hands.

What business was Kaito really in?

Leveraging X’s traffic, using tokens to incentivize content production, and selling the resulting data to projects for marketing.

X was the foundation. Kaito was the structure built on top.

The moment the owner of the foundation decides to reclaim it, the building collapses. No justification required. No negotiation needed. A single announcement is enough.

InfoFi claims to be about a decentralized attention economy. But the attention layer was never decentralized. The algorithm belongs to the platform. The API belongs to the platform. The users belong to the platform.

You can put points on-chain.

You can decentralize the token.

But you cannot decentralize Twitter.

A parasite attempting to overthrow its host does not trigger a revolution. The host simply pulls the plug.

Over the past few years, Web3 startups have repeatedly pursued this model: borrow Web2 traffic to build Web3 momentum. Users remain on Twitter. Data remains on Twitter. Attention remains on Twitter. But the token is self-issued, and the revenue flows inward.

It sounds clever—using leverage to achieve scale.

But someone else’s traffic will always belong to someone else. Platforms tolerate you only until you become inconvenient. Once you do, parasitic business models collapse instantly.

This should serve as a warning to every Web3 project built on borrowed platform traffic.

If your lifeline is controlled by someone else, then every dollar you earn exists only because it hasn’t yet been taken back.

Ask yourself whether you are building a company—or renting a room.

Renters should not think like landlords, and they certainly should not believe the house is theirs.

Kaito says it will move to YouTube and TikTok next.

But are those landlords really easier to negotiate with than Musk?

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Untitled

I’m sorry, but without content to rewrite, I’m unable to produce an article within the specified word count…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…