Why is RWA Suitable for Top-tier Enterprises an Industry Upgrade Pattern?

Original Article Title: "Why is RWA Suitable for Head Enterprise an Industry Upgrade Model?"

Original Author: Yekai (Wechat/Twitter: YekaiMeta)

Will the traditional manufacturing industry really be eliminated in the Web3 wave?

No! Despite the United States' efforts over the years to move manufacturing out of China, it is easy to move a factory but extremely challenging to move an entire industrial chain.

More importantly, as Bitcoin is about to become a reserve asset in multiple countries worldwide, how can traditional industries align with Bitcoin and seize this new opportunity?

The answer is: RWA Asset Tokenization. Through the tokenization of RWA (Real World Assets), traditional enterprises can not only establish a mapping relationship with Bitcoin but also achieve cross-border financing. For top-tier enterprises, the true value of RWA lies not only in financing but also in driving the digital upgrade of the entire industry chain and asset securitization.

What are the Pain Points for Enterprises?

1. Financing Difficulty: A single manufacturing enterprise finds it challenging to bear high annualized financing costs (annualized 7 points + 1/2 point financing cost) unless it can incorporate upstream and downstream scenarios and rewards together.

2. Poor Liquidity: Traditional assets are difficult to move quickly, causing companies to miss out on market opportunities.

3. High Friction Costs: The settlement and financing costs of traditional finance remain high, hindering industrial development.

Several key points for industrial upgrading actually correspond to several pain points of traditional industries:

Financing difficulty, so start with the equity-based underlying RWA assets, similar to U.S. Treasury bonds only being private placement and primary level;

Liquidity, corresponding to industrial trading and liquidity pools, Staking the first layer of RWA assets, making liquidity from exchanges and secondary markets;

High friction costs of traditional finance require a more significant and long-term approach, with industry scenarios requiring the integration of transactions with the industry to create industry stablecoins, PayFi, and industrial DeFi, reducing industry payment settlement and fund costs for investment and financing, revitalizing industrial upgrading and liquidity, thereby promoting the stability or growth of underlying RWA asset returns, ultimately forming a positive cycle.

In this field, we are the most professional, both in terms of depth and breadth, as well as interdisciplinary.

What to do? RWA is the antidote!

The heavy asset and supply chain advantages of traditional manufacturing are naturally suited to realize industrial upgrades through RWA. The core framework of industrial upgrading includes:

• Underlying Asset Pool: From raw materials to fixed assets, distributed on-chain, dynamically priced.

• Industrial Chain Scenarios: Building tokenized transactions and liquidity pools around mining, supply chain finance, international trade, etc.

• Industrial Finance and Stablecoin: Optimizing payment, financing, and settlement efficiency through industrial stablecoins and PayFi.

• RWA Trading Platform: Ultimately forming vertical exchange platforms and liquidity support.

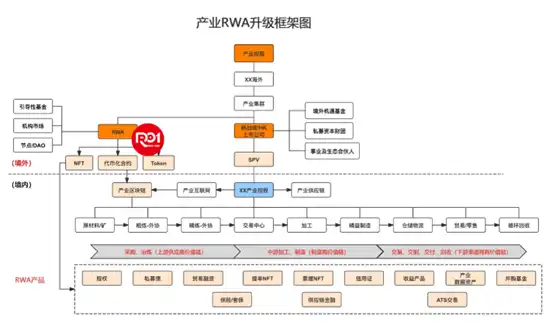

The opportunity points for leading enterprises lie in such an industrial upgrade framework: a distributed underlying asset pool for the industry, RWA assets + transactions/circulation + liquidity, RWA industrial finance, industrial stablecoins, and PayFi. As shown in the diagram:

(Figure Traditional Manufacturing Industry RWA Upgrade Framework)

The advantage of traditional manufacturing lies in heavy assets (underlying assets and fixed assets) and the supply chain. Therefore, the RWA upgrade framework for the traditional manufacturing industry can be divided into four layers:

Layer one, RWA underlying assets, a distributed asset pool, including raw material mine assets, fixed assets, liquid assets, liability-type assets, and more; this involves the tokenization of underlying assets for RWAs, achieving asset on-chain pooling, distributed asset pools, dynamic pricing, etc.

Layer two, industrial chain space + industrial chain scenarios, revolving around the entire manufacturing industry chain of mining processing, international trade, supply chain finance, warehousing logistics, consumption, production, incentive scenarios, as well as core scenarios such as industry chain transactions and liquidity pools, all have opportunities for RWA tokenization.

Layer three, industrial finance (Defi) and industrial stablecoin + PayFI, industrial stablecoins and industrial payment settlement and investment and financing scenarios, as well as encrypted smart finance based on industrial RWA assets for lending, futures, insurance, etc.

The fourth layer, RWA Industry Trading Platform, the upgraded ultimate will inevitably be an industrial RWA trading platform, with exchanges or top-tier exchange's vertical track platform and platform token.

Around traditional industrial upgrades, it will face the transformation issue of digitization and chain-based asset transformation.

This foundational work can simultaneously start with RWA financing to drive infrastructure development, mainly achieving the industry's "controllable assets + trusted asset management," where controllable is for on-chain tradability, deliverability, or control of delivery; trusted asset management involves industrial asset tokenization fundraise management, asset issuance, trading/investment, management, and exit.

For industrial upgrades, for the institutional market, the core is corporate credit, where RWA's controllability and trustworthiness are similar to the on-chain credit mechanism or Oracle mechanism.

Thus: RWA, for a company, is a bond issuance; for an industry, it is a new platform for assets and funds; for a region or country, it is a digital asset, stablecoin, and cryptographic financial system.

#ARAW Always RWA Always Win!

By 2025, the RWA market will rapidly find its place amidst rapid growth. In the new year, Kai will officially start recruiting disciples to mentor and guide. Young talents aspiring to the RWA direction are welcome to take the lead.

More and more friends are coming to ask specific project questions, which cannot be answered in detail on WeChat. A disciple class and practical study camp will be launched soon, so come to the classroom to diligently comprehend, interact, and conduct sandbox scenarios. You can add WeChat YekaiMeta to join the RWA Industry Research Group for discussions.

This article is a contribution and does not represent the views of BlockBeats.

You may also like

Cardano (ADA) Price Review for February 3

Cardano’s ADA price dropped 1% in the last day, trading at $0.2999, amid a broader red zone for…

Ripple Participates in Critical White House Summit

Ripple joined key crypto firms and banking giants at a White House meeting focused on stablecoin regulation, highlighting…

SHIB Price Analysis on February 3

SHIB’s rate dropped 0.74% in the last 24 hours, showing bears still hold sway. Hourly chart reveals rising…

Crypto Market Review: Shiba Inu’s (SHIB) 1,000,000,000,000 Bull Market Trigger, Bitcoin (BTC) Crash Might Stop Here, Is Dogecoin (DOGE) in Mini-Bull Market?

Shiba Inu shows a green candle with volume spike after decline, hinting at potential recovery but not confirming…

Crypto Apocalypse Imminent, Expert Who Predicted 2008 Financial Crisis Warns

Nouriel Roubini predicts a full-blown apocalypse for the cryptocurrency market, claiming it lacks real use cases beyond crime…

Top 3 Meme Coins Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery

Meme coins like Dogecoin, Shiba Inu, and MemeCore show recovery signs with price gains of 5.45%, 5%, and…

Trump Names Bitcoin-Friendly Kevin Warsh as Choice for Federal Reserve Chair

President Donald Trump nominated Kevin Warsh for Federal Reserve Chair, highlighting his pro-Bitcoin stance and policy experience. Warsh…

XRP Price Faces Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

XRP price hit a low of $1.500 this week, marking its lowest point since November 2024, with a…

Cardano Price Prediction as the Upcoming CME’s ADA Futures Launch Nears

Cardano price trades under pressure, stabilizing below $0.30 after a decline, showing compression rather than new weakness. CME…

Jeffrey Epstein Invested in Bitcoin Firm Blockstream, Invited Founder Adam Back to Island

Adam Back confirmed Jeffrey Epstein’s investment in Blockstream via a 2014 seed round through Joi Ito’s fund at…

SEC Chair Paul Atkins to Create History as First Sitting Chair to Speak at The Bitcoin Conference in Las Vegas

SEC Chairman Paul Atkins will speak at the Bitcoin 2026 Conference, marking the first time a sitting SEC…

HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Ignites Prediction-Style Trading Boom

Hyperliquid’s HYPE token price jumped above $37 with a 20% gain, landing it in the top 10 cryptocurrencies…

Trump States Crypto Reserve Will Hold XRP, Solana, Cardano—And ‘Obviously’ Bitcoin and Ethereum

President Trump announced a U.S. strategic crypto reserve including XRP, Solana, Cardano, Bitcoin, and Ethereum to position the…

Strategy Stock ($MSTR) Reaches 52-Week Low As Bitcoin Craters Below $84,000

Strategy ($MSTR) stock hit a 52-week low of $140.25 amid a sharp Bitcoin price drop below $84,000, with…

Jeffrey Epstein’s Strange Bitcoin Connections

The US Department of Justice released new Epstein Files detailing Jeffrey Epstein’s ties to Brock Pierce, a key…

Moonbirds NFTs Now Soaring Again: What’s Behind the Price Surge

Moonbirds NFTs, launched in 2022 by Kevin Rose’s Proof, saw their floor price crash from double-digit ETH to…

The Best Airdrop Hunts of the Month: January 2026

This guide spotlights five promising tokenless protocols for early airdrop opportunities in January 2026, curated to help users…

Is It a Crypto Winter? Burry Says $50K, Tiger Says No

Michael Burry predicts Bitcoin could drop to $50,000, triggering mining firm bankruptcies and a collapse in tokenized metals…

Cardano (ADA) Price Review for February 3

Cardano’s ADA price dropped 1% in the last day, trading at $0.2999, amid a broader red zone for…

Ripple Participates in Critical White House Summit

Ripple joined key crypto firms and banking giants at a White House meeting focused on stablecoin regulation, highlighting…

SHIB Price Analysis on February 3

SHIB’s rate dropped 0.74% in the last 24 hours, showing bears still hold sway. Hourly chart reveals rising…

Crypto Market Review: Shiba Inu’s (SHIB) 1,000,000,000,000 Bull Market Trigger, Bitcoin (BTC) Crash Might Stop Here, Is Dogecoin (DOGE) in Mini-Bull Market?

Shiba Inu shows a green candle with volume spike after decline, hinting at potential recovery but not confirming…

Crypto Apocalypse Imminent, Expert Who Predicted 2008 Financial Crisis Warns

Nouriel Roubini predicts a full-blown apocalypse for the cryptocurrency market, claiming it lacks real use cases beyond crime…

Top 3 Meme Coins Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery

Meme coins like Dogecoin, Shiba Inu, and MemeCore show recovery signs with price gains of 5.45%, 5%, and…