《The New York Times》: SEC's Crypto Lawsuit Against Trump to be Dismissed After His Return to the White House

Original Title: The S.E.C. Was Tough on Crypto. It Pulled Back After Trump Returned to Office

Original Authors: Ben Protess, Andrea Fuller, Sharon LaFraniere, Seamus Hughes, The New York Times

Original Translation: Luffy, Foresight News

A cryptocurrency company operated by billionaire brothers, the Winklevoss twins, once faced a tough federal lawsuit, but after Donald Trump returned to the White House, the U.S. Securities and Exchange Commission (SEC) decided to pause the case. Previously, the SEC had also filed a lawsuit against the world's largest cryptocurrency exchange, Binance, but this lawsuit was completely dropped after the new administration took office. Additionally, after years of litigation with Ripple Labs, the new SEC attempted to reduce the penalties imposed on this cryptocurrency company by the court.

An investigation by The New York Times found that the SEC's retreat in these cases reflected a comprehensive shift in the federal government's attitude toward the cryptocurrency industry after Trump began his second term. No regulatory agency has ever withdrawn multiple lawsuits against the same industry on such a large scale. However, The New York Times found that when Trump returned to office, over 60% of the progress in cryptocurrency-related cases that the SEC was pursuing had been relaxed—either by suspending the litigation process, reducing penalties, or directly dismissing the cases.

The investigation also pointed out that the move to dismiss cryptocurrency cases was particularly unusual. During Trump's presidency, the proportion of cryptocurrency-related cases dismissed by the SEC was much higher than that of cases in other industries. While the specifics of these cryptocurrency lawsuits varied, many of the companies involved had a common thread: financial ties to this self-proclaimed "crypto president," Trump.

As the highest federal agency regulating misconduct in the financial markets, the SEC has now ceased actively investigating any known businesses associated with Trump. Lawsuits against companies that had collaborated with the Trump family in cryptocurrency ventures or had supported his political activities have been dropped by the SEC. The remaining cryptocurrency-related cases with the agency involve defendants who are relatively unknown and have no apparent connection to Trump.

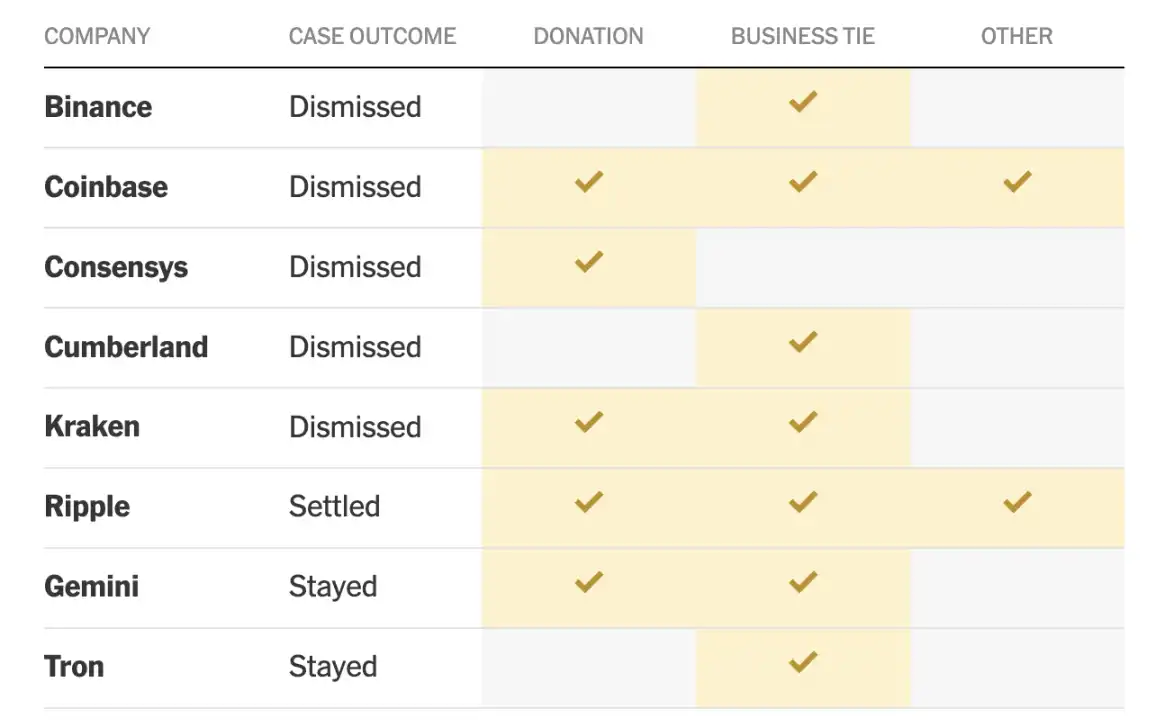

· The SEC has dismissed a total of 7 cryptocurrency cases, with 5 of the implicated companies known to have ties to Trump;

· In addition, 7 cryptocurrency cases have been suspended pending trial, with favorable settlement agreements or concessions being considered, 3 of which involve companies known to be associated with Trump;

· There are only 9 cases remaining that have not been dismissed, and the parties involved in these cases are not known to be associated with Trump.

In a statement, the SEC stated that there was never any political favoritism involved in handling cryptocurrency enforcement cases, and the adjustment in enforcement focus this time was based on legal and policy considerations, including doubts about its own regulatory authority over the cryptocurrency industry. The SEC also stated that even before Trump voiced support for the cryptocurrency industry, current Republican committee members fundamentally opposed bringing most cryptocurrency-related lawsuits, emphasizing that the SEC "places great emphasis on securities fraud issues and effectively safeguards the rights of investors."

Currently, there is no evidence to suggest that the President pressured the SEC to show favoritism toward specific cryptocurrency companies. The New York Times also did not find that these companies influenced the outcome of cases by providing political donations to Trump or engaging in business cooperation, with some financial transactions and business collaborations even occurring after the SEC adjusted its case handling approach.

However, the core issue is that Trump is both a participant in the cryptocurrency industry and the industry's highest policy maker. As President, if the policies he pursues align closely with his own interests, conflicts of interest may arise, and many cryptocurrency companies sued by the SEC are associated with him, highlighting the existence of such conflicts.

At the beginning of Trump's second term, the White House openly stated that the President would "stop harsh enforcement actions and overregulation that hinder cryptocurrency innovation." While the SEC's withdrawal of individual cryptocurrency cases had already attracted public attention, the New York Times found through analyzing thousands of court records and conducting dozens of interviews that the SEC's relaxation of cryptocurrency regulation this year far exceeded past levels, and Trump's allies in the cryptocurrency industry also benefited greatly from this, none of which had been fully exposed before.

All defendants involved in this investigation deny any wrongdoing, with many defendants claiming to only face procedural compliance issues. In addition, some cases that the SEC has eased handling involve companies that have no clear connection to the President.

SEC's newly appointed Chairman, Paul S. Atkins, stated that the cryptocurrency industry is entering a new chapter, a sentiment that cryptocurrency companies have welcomed.

White House Press Secretary Karoline Leavitt has refuted the claims of conflict of interest involving Trump and his family, stating that the relevant policies pushed by Trump are "fulfilling the President's commitment by promoting innovation, creating economic opportunities for all Americans, and helping the U.S. become a global cryptocurrency hub."

The Trump administration has significantly relaxed regulations on the cryptocurrency industry, with the U.S. Department of Justice even dissolving the cryptocurrency enforcement division. The SEC's policy shift this year can be described as a complete U-turn.

An analysis by The New York Times showed that during the Biden administration, the SEC averaged more than two cryptocurrency-related cases filed per month, with cases being litigated in federal courts and through internal agency legal systems. Even during Trump's first term, the SEC would file about one cryptocurrency-related case per month on average, including the high-profile Ripple lawsuit.

In stark contrast, after Trump's reelection, the SEC has not filed any cryptocurrency-related cases, while continuing to pursue dozens of cases against other industries.

In a statement, Atkins expressed that these SEC actions are simply correcting the previous government's overly aggressive regulatory stance towards the cryptocurrency industry. He stated that the SEC during the Biden era used enforcement powers to forcefully implement new policies. He also emphasized, "I have made it clear that we will completely abandon the enforcement-led regulatory approach."

Just as cryptocurrency companies are celebrating this new era, senior SEC attorneys who previously handled related cases are apprehensive about the trend of relaxed regulations. They are concerned that this institution, established during the Great Depression and with nearly a century of history, was originally intended to protect investor interests and maintain market order. Now, the relaxation of regulatory efforts may embolden the cryptocurrency industry, potentially harming consumer rights and introducing risks to the entire financial system.

Christopher E. Martin, a former senior litigation attorney at the SEC who once led a lawsuit against a cryptocurrency company, chose to retire after the SEC dropped the case earlier this year. Speaking of the SEC's widespread relaxation of regulation, he bluntly stated, "This is a complete capitulation, simply leading investors into a pit of fire."

Conclusion of Regulatory Suppression

The U.S. Securities and Exchange Commission building in Washington, D.C.

At the end of last year, inside the glass-walled SEC headquarters in Washington, regulatory action on cryptocurrency had nearly come to a standstill. SEC Chair Gary Gensler, who wanted to advance several cryptocurrency investigations during the Biden administration, now found his term winding down.

Previously, just after Trump announced a cryptocurrency project called World Liberty Financial with his family, he successfully secured a second presidential term and openly stated his intention to limit the SEC's power.

In fact, Trump was not always supportive of the cryptocurrency industry. During his first term, he once tweeted that cryptocurrency was nothing but air and could even promote illegal activities like drug trafficking. At that time, the SEC also took a tough regulatory stance, not only establishing a department to investigate network violations in the cryptocurrency field but also initiating dozens of related lawsuits.

During the Biden administration, the SEC's regulatory efforts regarding cryptocurrency were further intensified. In 2022, the large cryptocurrency exchange platform FTX collapsed dramatically, and the size of the SEC's cryptocurrency regulatory division almost doubled that year, with the team of lawyers and industry experts expanding to about 50 people.

Whether during Trump's first term or the Biden administration, the SEC has always believed that since investors may put their life savings into the cryptocurrency field, they have the right to understand the risks involved. However, a tricky legal issue has always plagued the SEC: does the agency really have the authority to bring related lawsuits against the cryptocurrency industry? The answer to this question depends on whether cryptocurrency is considered a security, a modern derivative of stocks and other financial instruments.

The SEC claims that many cryptocurrencies are inherently securities, so cryptocurrency exchanges and brokers, among other institutions, must register with the SEC, disclose detailed information as required, and some institutions even need to undergo independent audits. Failure to fulfill registration obligations may lead the SEC to file lawsuits under securities laws.

On the other hand, the cryptocurrency industry argues that most cryptocurrencies are not securities but rather a special type of financial product that should have exclusive regulatory rules, which the SEC has not yet established. Summer Mersinger, CEO of the Blockchain Association, a cryptocurrency industry association, said, "We do not want to evade regulation; we just hope to have clear and explicit rules as the basis for operation."

In 2024, a turning point began to emerge as Trump's attitude shifted from questioning cryptocurrency to fully endorsing it. In July of that year, during a speech, he promised cryptocurrency professionals that the "deliberate suppression" of the industry would soon end and proclaimed, "I will fire Gary Gensler on the first day in office."

During the Bitcoin conference held in Nashville in 2024, Trump made positive comments about cryptocurrency, a departure from his previous skepticism.

The SEC, as an independent agency, has 5 commissioners appointed by the President, with the chairman typically aligning with the appointing administration's stance. Decisions on whether to bring a case, settle, or dismiss require a vote by the commissioners, but the actual investigative work is carried out by dedicated enforcement staff. This framework allows for flexible adjustment of regulatory focus while avoiding significant policy swings due to shifts in political winds.

Following Trump's re-election, there was a significant shift in the SEC's atmosphere. Shortly after the election, Gensler announced his resignation. The previously sought-after position in cryptocurrency regulation within the agency suddenly became a 'hot potato.'

During the presidential transition period, a confidential source revealed that Sanjay Wadhwa, the head of enforcement under Gensler, pleaded with enforcement staff to "do the job that the American people are paying us to do."

However, some staff members began to backpedal. According to sources, a senior manager in the cryptocurrency regulation team took an unauthorized several-week vacation, ignored emails related to cases, another manager refused to sign off on the few cryptocurrency-related case documents filed by the SEC after the election, and some staff simply stopped working on cryptocurrency cases, completely thwarting Gensler's efforts to advance regulation in the final stages.

Victor Suthammanont served at the SEC for a decade, holding the position of enforcement advisor to Gensler before resigning. He stated that through two previous government transitions, staff members remained at their posts and carried out their duties as usual. "But this transition was completely different, the internal atmosphere of the organization changed instantly." Suthammanont said, although he did not discuss specific cases.

Following Trump's re-election, Gary Gensler announced he would resign

Once Trump was sworn in, the situation became irreversible. He first appointed Republican SEC Commissioner Mark T. Uyeda as acting chair, until his nominee Paul S. Atkins was confirmed by the Senate. Uyeda, who had long been critical of the SEC's approach to handling cryptocurrency cases, stated in an interview with The New York Times that many of Gensler's regulatory actions were based on "new theories lacking support from existing law."

However, as early as 2022, Gensler expressed a completely opposite view in a speech, stating: "Even with the emergence of new technology, existing laws will not become obsolete."

In early February 2025, Uyeda transferred Jorge G. Tenreiro out of the SEC's litigation director role. Tenreiro had previously led the cryptocurrency regulatory division and had overseen many related cases, but this time he was reassigned to the information technology department, which was seen internally at the SEC as a demotion with humiliating implications.

After Tenreiro's departure, the SEC began halting investigations into several cryptocurrency companies that may be facing litigation. While some investigations are still ongoing, at least 10 companies have publicly announced that they are no longer under SEC investigation, with one company having just issued a related announcement last week.

No Room for Negotiation

Mark T. Uyeda is one of the Republican Commissioners of the U.S. Securities and Exchange Commission and served as Acting Chair before Atkins was confirmed by the Senate.

Uyeda soon faced an even more challenging dilemma: how to handle those cryptocurrency litigation cases that were still pending from the Biden administration. While suspending investigations at the SEC is common, dismissing cases that are already in progress is extremely rare and requires a vote of approval from the Commission's commissioners.

The United States' largest cryptocurrency exchange platform, Coinbase, was sued by the SEC for failing to fulfill its registration obligations, in a highly anticipated case in the cryptocurrency space. During the Biden administration, Coinbase took a tough defense strategy, successfully convincing the judge to allow a higher court to review the case before trial.

Now under the Trump administration's control, the SEC has become one of the first companies to apply for the withdrawal of their case. Typically, the SEC Chairman's office does not intervene in the negotiation of such cases, leaving it to dedicated enforcement staff. However, during this negotiation process, Uyeda's office staff participated in discussions with Coinbase alongside the enforcement lawyers.

Coinbase's Chief Legal Officer, Paul Grewal, a former federal judge, stated in an interview: "We always ensure timely synchronization of case negotiation progress with the Chairman's office to ensure a comprehensive understanding of the situation." Uyeda, on the other hand, stated that his staff's participation in such negotiation meetings is "completely compliant with regulations."

Initially, the SEC under Uyeda's leadership was not willing to completely dismiss the case. Insiders revealed that the SEC's initial proposal was merely to pause the case. However, this proposal was rejected by Coinbase.

Subsequently, the SEC made a bigger concession, offering to dismiss the case but retaining the right to reopen it in the future if there was a change in leadership's stance. However, this proposal was still not accepted by Coinbase. Grewal firmly stated, "Our position is very clear: either they completely drop the lawsuit, or we continue to defend against it. There is no room for negotiation in this matter."

Ultimately, the SEC chose to compromise. At that time, two Democratic commissioners, including Gensler, had left, leaving the SEC Commission with only two Republican commissioners and one Democratic commissioner.

While Uyeda did not respond specifically to this decision, he stated, "Continuing to pursue cases like this is not appropriate, especially if the SEC may no longer endorse the relevant legal theories the case is based on in the short term. In such a context, pushing forward should not be insisted upon."

SEC's sole remaining Democratic commissioner, Caroline A. Crenshaw, bluntly stated in an interview that the SEC's actions allowed the cryptocurrency industry to have the upper hand, stating, "They can do almost anything they want without facing any consequences."

Shift in Attitude

Caroline A. Crenshaw is the only Democratic commissioner at the SEC

Following the dismissal of the Coinbase case, the cryptocurrency industry widely interpreted it as a signal of the SEC's compromise. Lawyers from other cryptocurrency companies also followed suit, seeking similar outcomes for their respective clients. By the end of May, the SEC had dismissed an additional 6 cryptocurrency-related cases.

An analysis of court records by The New York Times found this phenomenon to be highly unusual. During the Biden administration, the SEC had never voluntarily dismissed any of the cryptocurrency cases carried over from Trump's first term. Only due to the death of one defendant and an unfavorable ruling by a judge in another case did the SEC dismiss one case and partially dismiss another case's litigation request.

Surprisingly, during Trump's second term, 33% of cryptocurrency cases inherited from the Biden administration were dismissed, while the dismissal rate for cases in other industries was only 4%.

Despite the SEC's repeated commitment to continuing to pursue securities fraud, it has nonetheless dismissed the lawsuit against Binance. Previously, the SEC accused two affiliated entities under Binance of fraud, stating that they misled consumers in preventing market manipulation.

Furthermore, the SEC has also applied to the court to suspend the fraud case against Justin Sun and his founded Tron Foundation. There are a total of 4 such cases that have been suspended pending settlement negotiations, and the SEC has not yet disclosed the outcome of this case.

The Trump administration has taken over a total of 23 cryptocurrency cases, with 21 originating during the Biden administration and 2 being cases left over from Trump's first term, of which the SEC has taken a lenient approach to 14 cases. In these 14 cases, 8 of the implicated companies had established connections with Trump and his family both before and after the case.

Cryptocurrency Companies' Connections to Trump or His Family Enterprises

For example, Justin Sun once spent $75 million to purchase tokens issued by World Liberty Financial. The Tron Foundation did not respond to reporters' repeated requests for comments, while Justin Sun and the Tron Foundation stated in court documents that the SEC not only lacks evidence to prove the existence of fraud but also has no right to bring a lawsuit against them.

In the weeks before the dismissal of the Binance case, the company was involved in a $20 billion business transaction that utilized stablecoins issued by World Liberty Financial. This transaction is expected to bring tens of millions of dollars in annual revenue to the Trump family.

A spokesperson for World Liberty Financial stated that "the company has no affiliation with the U.S. government" and "will not have any influence on government policy-making and decision-making processes." In a statement, Binance claimed that the SEC's lawsuit against them is essentially "targeted suppression of the cryptocurrency industry."

In March 2025, the SEC dismissed the case against cryptocurrency exchange Cumberland for conducting securities trading without registration. About two months later, Cumberland's parent company, DRW, invested nearly $1 billion in a media company owned by the Trump family. Executives at DRW stated that the company only had the investment opportunity after the case was dismissed, and the SEC dropped the case simply because the related charges lacked factual basis.

Ripple once donated nearly $5 million to Trump's inauguration ceremony and the company has also been embroiled in legal battles. During Trump's first term, the SEC accused Ripple of not disclosing key information to investors when issuing cryptocurrency tokens. Last year, a federal judge dismissed some of the SEC's charges but still ruled that Ripple had committed securities violations and imposed a $125 million fine on the company.

After Trump returned to office, the SEC attempted to reduce the fine amount to $50 million. The judge harshly criticized the SEC for its flip-flopping behavior and rejected this request. Ripple argued to the judge that it should receive a lighter penalty, in part because the SEC had dropped several subsequent lawsuits related to similar cryptocurrency cases. Ultimately, Ripple still paid the full fine. In July of this year, a media company owned by the Trump family announced plans to include Ripple-issued cryptocurrency in a public-facing investment fund.

Hester Peirce is an SEC Republican commissioner and is also responsible for the agency's newly formed cryptocurrency special working group. In an interview, she stated that dismissing many cryptocurrency cases was a way to correct past mistakes, as these cases should never have been brought in the first place.

She said: "I think the real overreach happened in the prior years, when many of the SEC's cases were baseless from the get-go." She also added that these lawsuits hindered legitimate industry innovation. Peirce emphasized that case handling is solely based on facts and specific circumstances, with no consideration for "connections to the parties involved" and no mixture of any political or economic factors.

Financial Resources

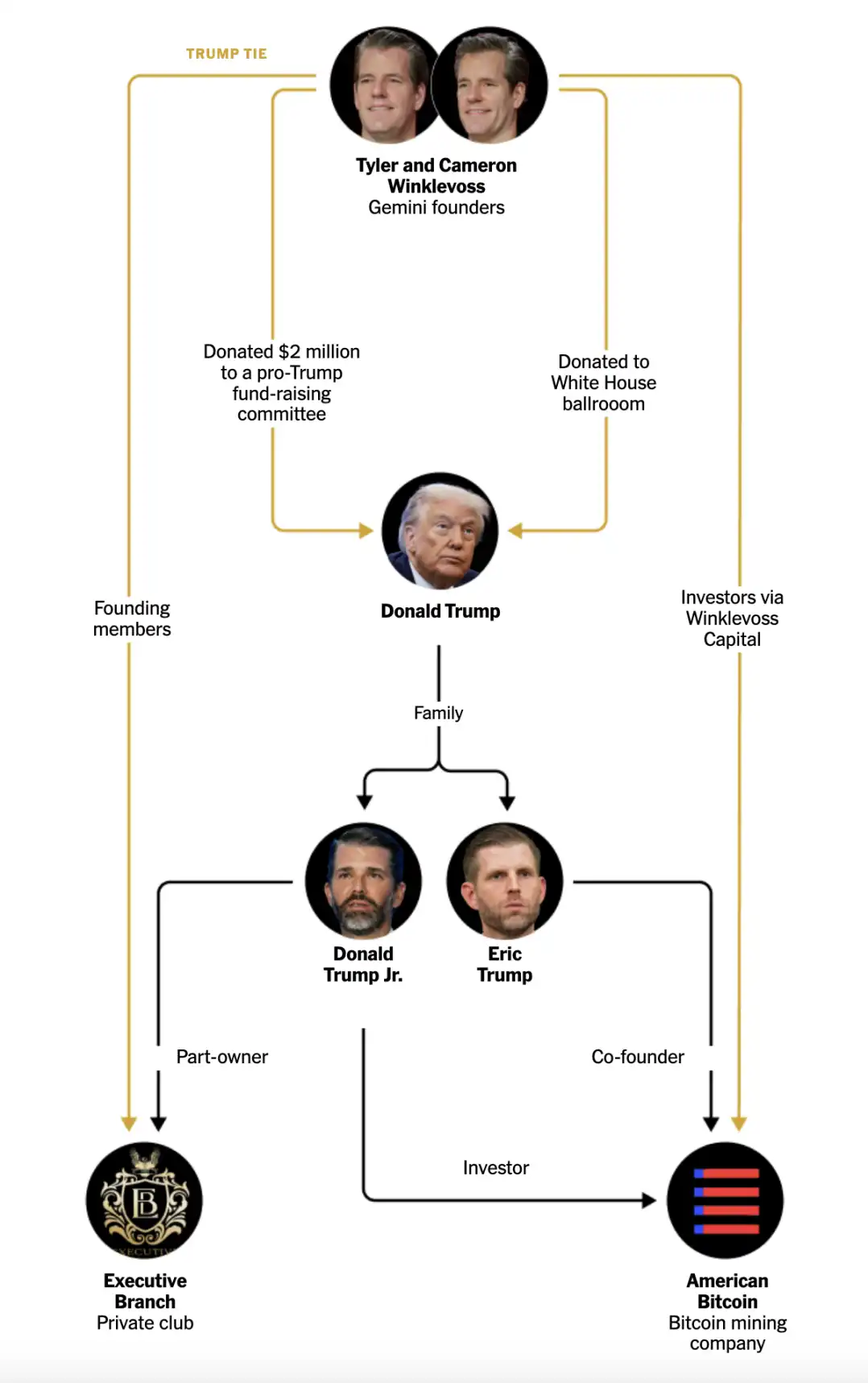

In the cryptocurrency industry, few people are closer to Trump than the Winklevoss brothers, Tyler Winklevoss and Cameron Winklevoss. This brother duo founded and operates the cryptocurrency company Gemini Trust. Not only have they provided financial support to the fundraising committee for Trump's re-election and other Republican-related organizations, but they have also contributed to the renovation of the White House banquet hall, a project favored by Trump. In addition, they have funded a high-end private club in Washington called Executive Branch, of which Trump's eldest son, Donald Trump Jr., is a shareholder.

Under the brothers' investment company, they recently invested in a new cryptocurrency mining company called American Bitcoin. Eric Trump, Trump's second son, is a co-founder and chief strategy officer of this company, and Donald Trump Jr., the eldest son, has also participated in the investment.

The Winklevoss Brothers' Relationship with the Trump Family

Trump has publicly praised the Winklevoss twins multiple times, calling them individuals who possess both intelligence and good looks. He commented at a White House event, saying, "They are good-looking, smart, and have a massive amount of wealth."

However, Gemini Trust has also been involved in legal disputes.

In December 2020, Gemini Trust partnered with another company, Genesis Global Capital, to offer a service to Gemini's clients to lend their crypto assets to Genesis, which would then lend these assets to larger institutional investors.

Genesis would pay interest to users and promised that users could redeem their assets at any time; Gemini would act as an intermediary and earn a corresponding share. Gemini had publicly promoted that the project could provide an annualized return of up to 8% for account holders.

San Diego data scientist Peter Chen, in an interview, mentioned that he trusted Gemini and had invested over $70,000 in the project.

"Gemini gave me the impression of operating in compliance, strictly following the rules, and being one of the most well-regulated companies in the cryptocurrency field," he recalled.

Peter Chen stated that his reason for investing over $70,000 in Genesis was because he trusted Gemini Trust.

However, by the end of 2022, Genesis faced a bankruptcy crisis and froze the accounts of 230,000 customers.

A 73-year-old grandmother had once pleaded with Gemini to return her entire life savings of $199,000. Lawsuit documents filed by the New York State regulatory agency revealed that in her plea, she wrote, "Without this money, I am completely at a loss."

In May 2024, Genesis reached a $2 billion settlement with the New York State regulatory agency, allowing customers' funds to be recovered. Gemini also settled with New York State, committing to pay up to $50 million if necessary to compensate for customers' remaining losses. Gemini insisted on its innocence, attributing this crisis to Genesis, and emphasized that ultimately no customers incurred losses.

However, the SEC has also sued both companies, alleging that they conducted unregistered sales of crypto assets. Tyler Winklevoss referred to this lawsuit as a "baseless persecution" on social media.

Genesis chose to settle with the SEC, but Gemini decided to fight the charges. It wasn't until April 2025 that the SEC suddenly moved to pause the case to allow for a negotiated settlement. In September of the same year, the SEC disclosed that it had reached a settlement agreement with Gemini, which is currently pending a vote by the commissioners.

The SEC informed the federal judge overseeing the case that the agreement "will permanently resolve this litigation dispute."

You may also like

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Earn

Earn