No One’s Having Fun in the Casino Economy, America’s Youth Is Losing Confidence in the Future

Original Title: Everyone is Gambling and No One is Happy

Original Author: kyla scanlon, Macro Analyst

Original Translation: KarenZ, Foresight News

Most people are quite friendly. But living in society means facing others' different underlying norms. Some people will cough without covering their mouths, that's just how it is. I have a theory: they may consider collective comfort not to be their responsibility, perhaps because they lack a sense of belonging in the public domain. This is a social drift phenomenon that is becoming increasingly apparent in public spaces (such as staring at a phone with a 90-degree tilt and walking into a wall, or standing in the main pedestrian thoroughfare obstructing traffic).

But I believe there are many similarities between these coughing individuals and the sustained economic downturn we are witnessing. If you have lost trust in the system around you, then why adhere to collective norms? Hard work seems unrewarding, so why not take a "gamble"? Institutions are lying! But that YouTuber who made the cover image won't lie; he points with a wide-mouthed expression at a bowl of pasta, posing some "profound questions." We no longer trust each other. As Jordan Schwartz, chair of the Harvard Public Opinion Project, said:

"Generation Z is on a path that may threaten American democracy and the future stability of society. This is a five-alarm crisis, and if we hope to restore young people's confidence in politics, America, and each other, we must act immediately."

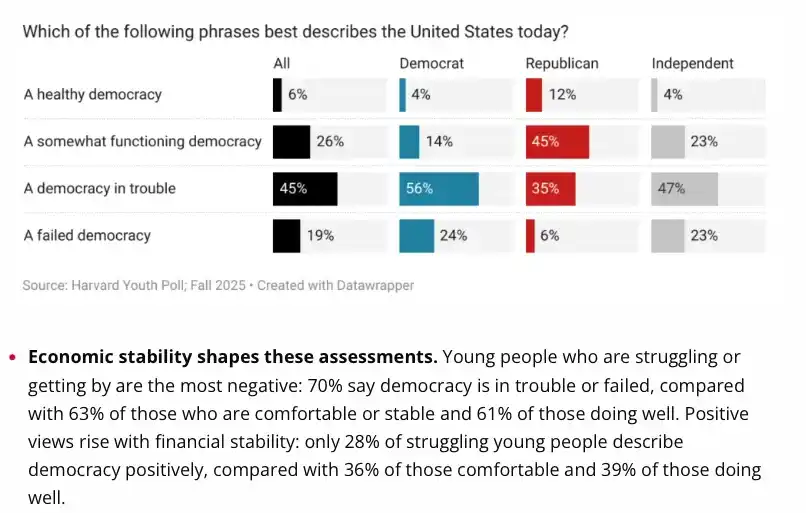

The project he oversees—the Harvard Youth Poll—surveyed over 2,000 Americans aged 18 to 29 on trust, politics, and artificial intelligence. When asked whether they believed America is a healthy democracy, respondents' answers showed clear partisan divides, but concern was evident.

Trust between groups is also eroding. Only 35% of young Americans believe that people with different views want the country to move in a positive direction. 50% consider mainstream media a threat. And only 30% believe that their economic situation will be better than their parents'.

Therefore, from this survey, we can identify three noteworthy issues:

1. Concerns About Democracy

2. Concerns About the Economy

3. Concerns About Each Other

I believe that without understanding how we talk about the economy, we cannot truly understand the economy itself. Here, we are facing the compounded effects of three factors:

(1) The post-pandemic adaptation process;

(2) "Micro Solipsism" triggered by smartphones;

(3) The younger generation witnessing objectively unfriendly behavior in politics being rewarded instead.

People are (understandably) undergoing a form of "cognitive drift," some even referring to it as "medieval peasant brain," which is related to the ongoing information deluge of the internet (e.g., some people putting potatoes in socks for "detoxification"). We are trapped in a compounded crisis — the interaction of economic deterioration and cognitive overload has formed a recursive trap, with each side exacerbating the other, destroying the resources needed to break free.

· Economic Pressure (e.g., Baumol's cost disease, housing issues, labor market weakness) has weakened our ability for clear thinking, making us more susceptible to scams, poor decisions, and exploitative markets, which in turn further intensify the economic pressure.

· Economic Pressure + Information Overload has eroded trust in institutions.

· Loss of Trust has made coordination impossible, problems unsolvable, and unresolved problems have further deepened the crisis.

Currently, we are trying to understand the economy in a social and cognitive environment where change is faster than traditional economic indicators. This is the backdrop of "Vibecession."

Note: With Paul Krugman and Scott Alexander recently bringing up this concept again, it is meaningful to reexamine the past meanings of "vibecession" and its evolution today.

"Vibecession": Then and Now

I first introduced the concept of "vibecession" in July 2022. At that time, inflation was receding (but still painfully high), the labor market was recovering, and the economy was growing. AI had not yet taken center stage, there were no tariff barriers, and large-scale infrastructure investments were underway. From a data perspective, everything seemed to be improving.

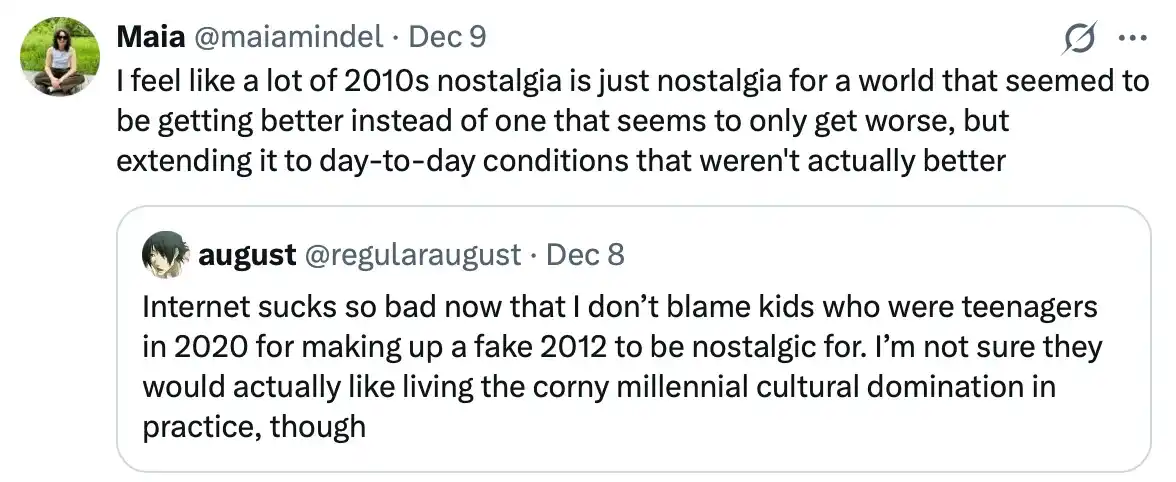

Although there were many problems in the 2000s and 2010s (really a lot!), people's emotions did not completely collapse. Today, there is even a nostalgia trend on TikTok (nostalgiacore), where teenagers have created a romanticized vision of "2012" — they long for infinity scarves, third-wave artisanal coffee shops, and a time when Instagram was used to share photos of daisies in the field, rather than the battleground of hypercompetitive algorithms it is today.

There was still a glimmer of hope back then (this was also the core idea of Obama's campaign!), as people held a "better" expectation for the future of the internet. Although the internet had some issues at the time, there wasn't yet the phenomenon of profiting from manufacturing outrage as we see today.

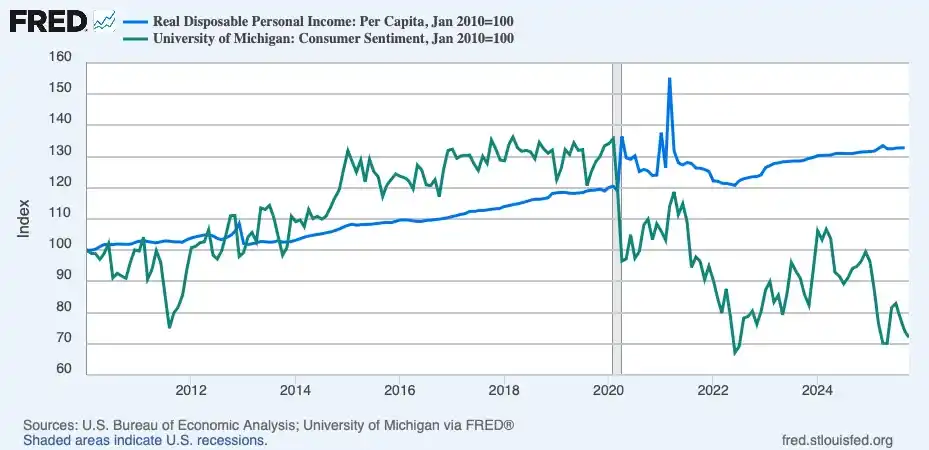

Some claim that "the entire last decade was an atmosphere recession (Vibecession)," but emotional data does not support this claim. In fact, the emotional fracture was evident and sharp.

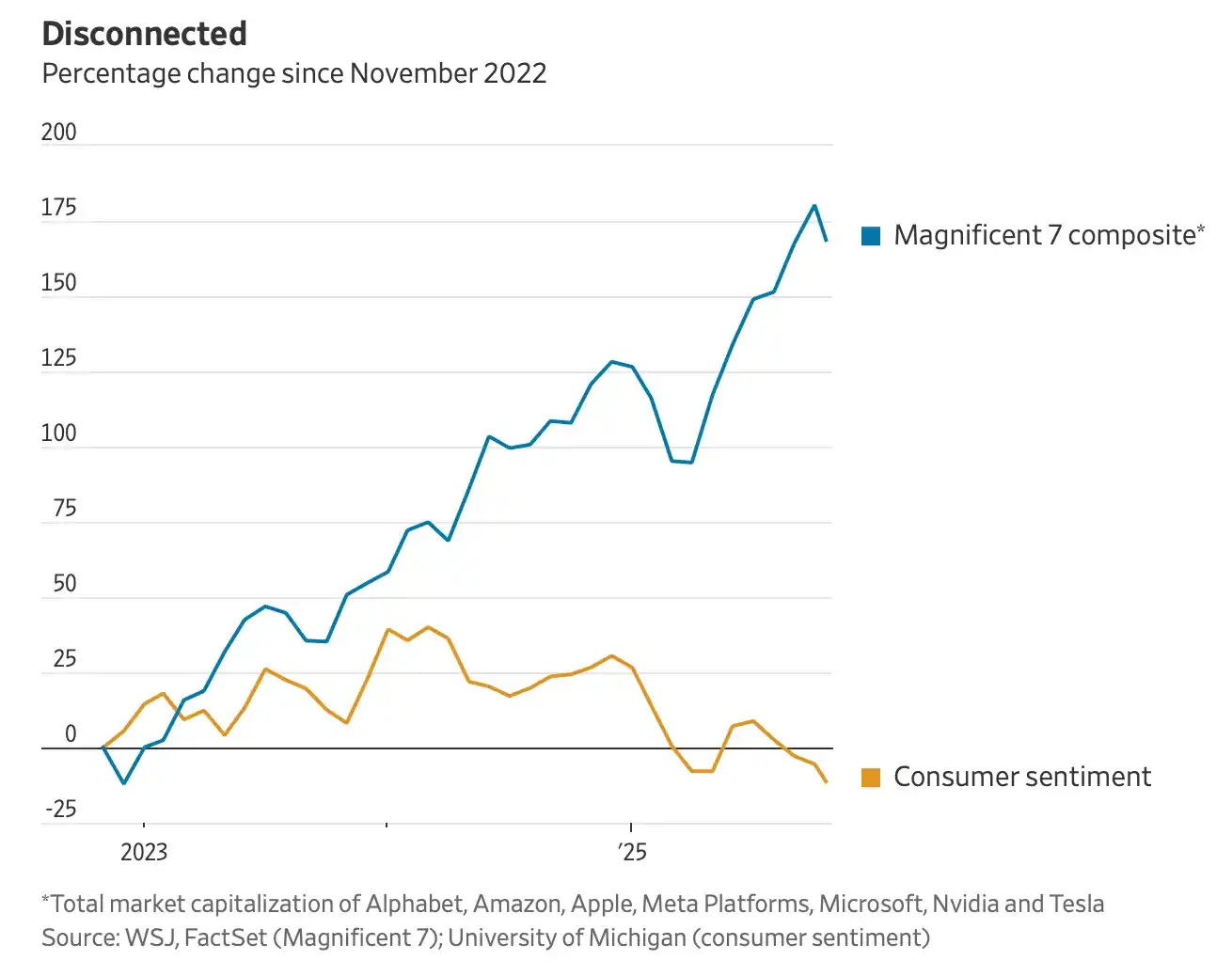

The chart below roughly illustrates the beginning of the "atmosphere recession," showing the divergence trend between emotions and economic data. Following the shock of the pandemic, real disposable income recovered and continued to grow, returning to a normal trend. However, public sentiment never recovered. It plummeted into a range similar to an economic recession (or even lower) and has remained there, even as the economic fundamentals have stabilized.

I believe part of the reason lies in the accumulation effect. The chaos brought about by the pandemic is not over; the prices of various goods remain unstable, stores are understaffed, teachers and students are exhausted, the public information dissemination system has collapsed, and institutions appear fragile. Daily life's friction has increased in countless small details. The surge in housing prices during the pandemic has not receded. With the Fed beginning to raise interest rates, mortgage rates are "locking" people in place. Rent prices are soaring, and the path to adult life — moving, renting, saving, buying a home — has shattered for many. If you didn't buy a house before 2020, you might never be able to.

But as Dan Davies wrote, the "atmosphere recession" might not have a specific trigger point. "The atmosphere is like a supercooled liquid, just waiting for a random impact to trigger its phase change." And the pandemic was that impact.

The atmosphere recession came early. Today, economic data is more in line with people's emotions, or at least closer than in the past. What we face now is a low-recruitment environment, persistent inflation, and extremely strange trade policies. When the National Bureau of Economic Research (NBER) defines an economic recession, it looks at three aspects:

· Depth: How severe is the economic decline?

· Breadth: How widely is the pain spread?

· Duration: How long does it all last?

If we look at the decline in consumer sentiment, it roughly fits the definition of an economic recession - long duration, broad impact, and sentiment levels steadily approaching historical lows. Schwab's Kevin Gordon has referred to it as "Vibepression" - extreme emotional low while GDP is propped up by AI-related investments. Can an economy thriving due to AI data center construction bring happiness to the average person? The answer is clearly no!

But why do we have this profound sense of melancholy?

Part 1: Economic Deterioration

A few weeks ago, Michael Green published an article claiming that "$140,000 is the new poverty line," highlighting that almost no one can afford the cost of participation in society today. This article sparked a heated debate on the Internet. Subsequently, individuals like Tyler Cowen and Jeremy Horpedahl published rebuttals. However, as John Burn-Murdoch wrote, the reactions to this article were interesting in themselves.

Most people strongly agreed with the article's points (many rebuttals were countered with "Who cares if the data is accurate, the vibe is right!"). The article was republished by outlets like More Perfect Union and The Free Press. People across the political spectrum read the article and said, "Yes, this is why everything feels so bad. This is poverty. My economic pain has finally been validated by data. It's a kind of relief."

Being "seen" in the analysis is a form of relief. Paul Krugman, in his series of articles on "Vibecession," pointed out three key concepts that traditional economic data have not captured well:

· Economic Participation: Can you afford the cost of participating in society?

· Sense of Security: Are you just one bad tooth away from bankruptcy?

· Fairness: Are you being deceived?

People need to feel that they can afford the expenses of a house, children, or a car, that they will not go bankrupt due to a medical bill, and that others are not deceiving them. The answers to these questions are becoming increasingly difficult to ascertain.

Regarding the first question — the Fed's interest rate cut yesterday sparked much controversy and disagreement. Their dual mandate — price stability and maximum employment — is facing increasing pressure. Inflation has not dropped to the 2% target (the bond market is very concerned about this). The labor market is weakening, and inequality is worsening.

There is indeed very real economic pain, making participation in society increasingly difficult. Young people once voted to support Trump to improve the economy, but now they are turning against him. According to the Yale Youth Fall 2025 Poll, young people aged 18 to 29 are showing strong dissatisfaction with President Trump's economic handling.

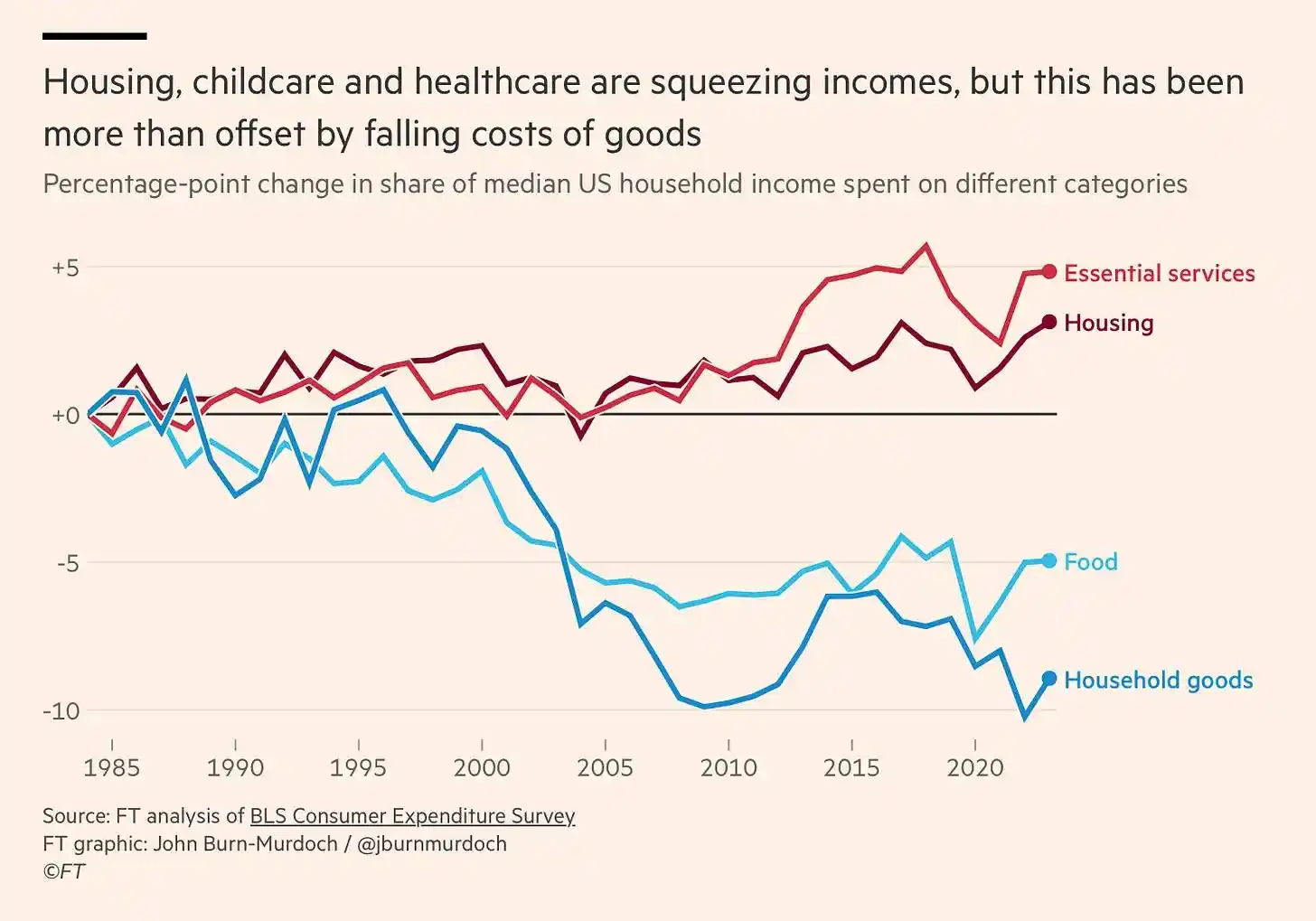

John Burn-Murdoch points out that we are facing "Baumol's Cost Disease."

The same productivity growth that drives down prices of tradable goods is causing costs to skyrocket in face-to-face services. Industries like healthcare and education that require intensive face-to-face labor, due to slow productivity growth (or even no growth at all), have to increase wage levels to attract labor that might otherwise choose high-paying jobs in higher productivity industries. The result is that even if the variety of goods and services people consume remains the same, with the improvement of the national standard of living, they will find more and more of their expenditures going towards basic services.

Prosperity may actually make life more expensive.

Source: The Financial Times - Paul Starr documented the collapse of cultural affordability under Baumol's Cost Disease in The American Prospect, pointing out that "public elementary and secondary schools, public libraries, low-tuition land-grant colleges, and 20th-century mass media — including free over-the-air broadcasting and television" were once free or at least heavily subsidized. However, support for arts and education is now being cut.

In reality, this means that the core elements of middle-class life—housing, healthcare, childcare, education, and retirement—all fall within the realm of Baumol's cost disease. The costs in these areas are rising faster than wage growth. Even if you "do everything right," you may still feel like you can't make ends meet.

In the 20th century, we addressed Baumol's cost disease to some extent through the socialization or heavy subsidization of these areas, such as public schools, public libraries, low-cost state universities, and public hospitals. Through policy, we made these expensive and low-productivity areas more affordable. However, at this most inopportune time, we are privatizing (or dismantling, bureaucratizing) these areas. We are asking families to bear costs that were previously shared socially. Is it any wonder the middle class is feeling the squeeze?

Of course, things will only get more complicated. Artificial intelligence will make the productivity of non-Baumol's areas super-efficient. Fields like software development, data analysis, and any computer-related work will become rich and cheap, meaning the productivity gap between scalable and non-scalable areas will become a huge chasm.

The second issue—this year, the government shut down over healthcare issues. The average healthcare cost for a family of four is $27,000 per year. Next year, insurance costs are expected to rise by 10%-20%. Many are just one bad tooth away from bankruptcy.

The third issue—we are rapidly advancing in an "quid-pro-quo" economic model. The U.S., once a beacon of democracy, is now engaging in land swaps with Russia, demanding five years of social media data from visitors, threatening the independence of institutions including the Fed, and ignoring antitrust laws to support media control. When you read such news and see such headlines, naturally, you feel very bad.

Therefore, for many, especially young people trying to build a life, the economic fundamentals have indeed worsened. But solely relying on economic pressures cannot fully explain this profound sense of anxiety. This is where cognitive factors come into play.

Part 2: Cognitive Overload

These issues aren't actually new, right? For years, the U.S. has been sliding towards a more precarious balancing act. People have long experienced high housing costs, a tense job market, and the impact of Baumol's cost disease. However, the difference today is that these pressures are falling on a public already overwhelmed in cognition and social interaction.

For most of human history, literacy was scarce, and attention was abundant. Besides work, people spent most of their time in what we now call a "bored" state. Today, the situation is quite the opposite—literacy is declining, attention has become a commodity, and people's cognitive load is completely overloaded. Jean Twenge wrote in The New York Times in an article titled "The Screen That Ate Your Child's Education":

In a study published in October in The Journal of Adolescence, I found that in countries where students spend more time using electronic devices for recreational purposes during school, the decline in standardized test scores in math, reading, and science is significantly greater than in countries where less time is spent.

Meanwhile, Brady Brickner-Wood wrote in The Curious Notoriety of Performative Reading:

Americans' leisure reading time has decreased by 40% compared to twenty years ago, and 40% of fourth graders lack basic reading comprehension skills... Meanwhile, universities are partnering with companies like OpenAI to introduce chatbots into student curricula, while humanities departments are continuously being cut.

If you don't trust any sources of information, you won't trust economic data either. We conducted a massive experiment—giving people unrestricted access to millions of things that could overwhelm them—the answer is, no, really no, this approach is like boiling an entire population into one egg.

The loss of education and deep reading has led to various chain reactions: weak foundational skills, declining media literacy, and most importantly, a collapse of trust. David Bauder's research on teen news consumption shows that "about half of the surveyed teens believe that reporters give special treatment to advertisers and fabricate details such as quotes."

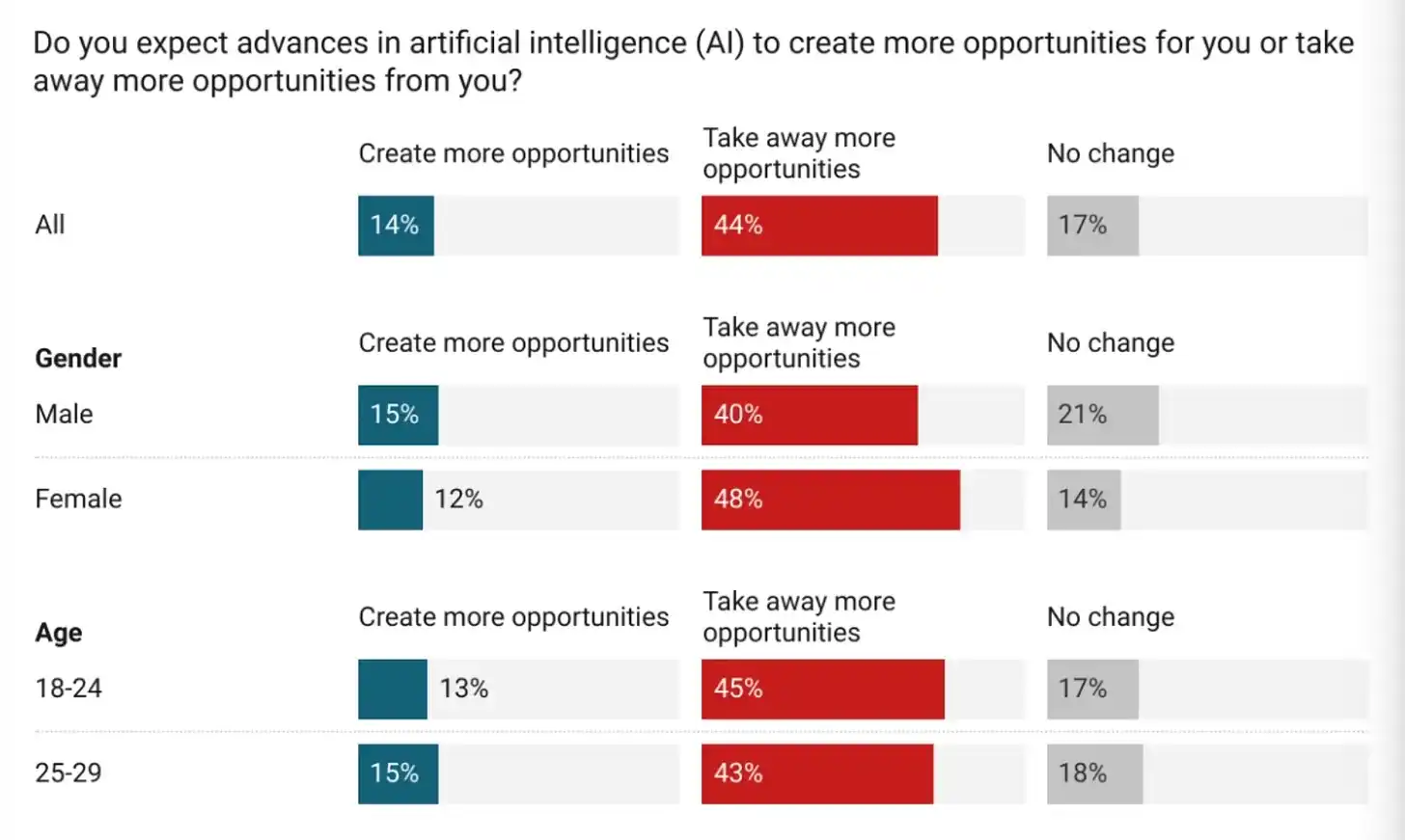

Artificial intelligence will only make all of this more complex. Greg Ip's article in The Wall Street Journal titled The Most Joyless Tech Revolution Ever: AI Is Making Us Rich and Unhappy sums it up very well. Nearly two-thirds of people feel uneasy about AI, and only 40% trust the AI industry to do the right thing. We have all this technology, but we trust neither each other, nor do we feel very good.

Source: Greg Ip, The Wall Street Journal (WSJ)

So, when we talk about negative emotions, there is indeed a kind of "computerization" quality running through it.

We are collectively plagued by the "Bullshit Asymmetry Principle": we find that the difficulty of debunking a lie is indeed 10 times that of creating one. This has led to marketing and product strategies such as "ragebait"—is this also a good way to raise a lot of venture capital?

False information has become an effective means of accumulating wealth: if you lie to many people and make them angry at you, Twitter will pay you a large sum of money. People abroad are also using this "printing press"—which in logic makes sense!—and are contaminating American politics in a way that might be considered illegal?

Many people are also profiteering at various levels, gaining an advantage through cheating, as Krugman mentioned the "scams" issue. Every adult can feel their attention slipping away, their thinking becoming flattened, their world full of noise, devoid of neutrality, and with no institution truly existing to protect them. Brother, your brain is being sold—along with your attention slipping away, your cognitive abilities, sense of depth, and certainty disappear with it.

Confidence, optimism, and long-term thinking all require "mental space." If the information environment becomes chaotic, the emotional environment will also become chaotic. And if attention is the foundation of democracy, then this infrastructure is already badly damaged.

We are witnessing the consequences of outsourcing human learning to screens. Now, we may see what the consequences are of outsourcing humanity itself to artificial intelligence. When you can't trust any source of information, you can't trust economic data. When attention is divided and thinking is flattened, people become more susceptible to the next stage of influence: exploitation.

Part Three: Exploitative Economy

As the cognitive world gradually collapses, the maintenance of the physical world is also less than satisfactory. The increasing friction between the decaying elements in the physical realm (such as bridges, schools, labor markets) and the over-optimized elements in the digital realm (such as large language models, algorithms, and various operations in the advertising field) is becoming increasingly evident.

In this communication, I hold a rather stern attitude towards artificial intelligence (AI)—it needs to be made clear that I believe AI is a tool that can indeed bring significant breakthroughs to science—but AI itself is creating a thorough downward spiral. In a documentary, Demis Hassabis' discussion on AI is crucial, and as Linus Torvalds said in a recent interview:

I strongly believe in the potential of AI, but I am not optimistic about the things surrounding AI. I feel the market and marketing are both sick. This will lead to a collapse.

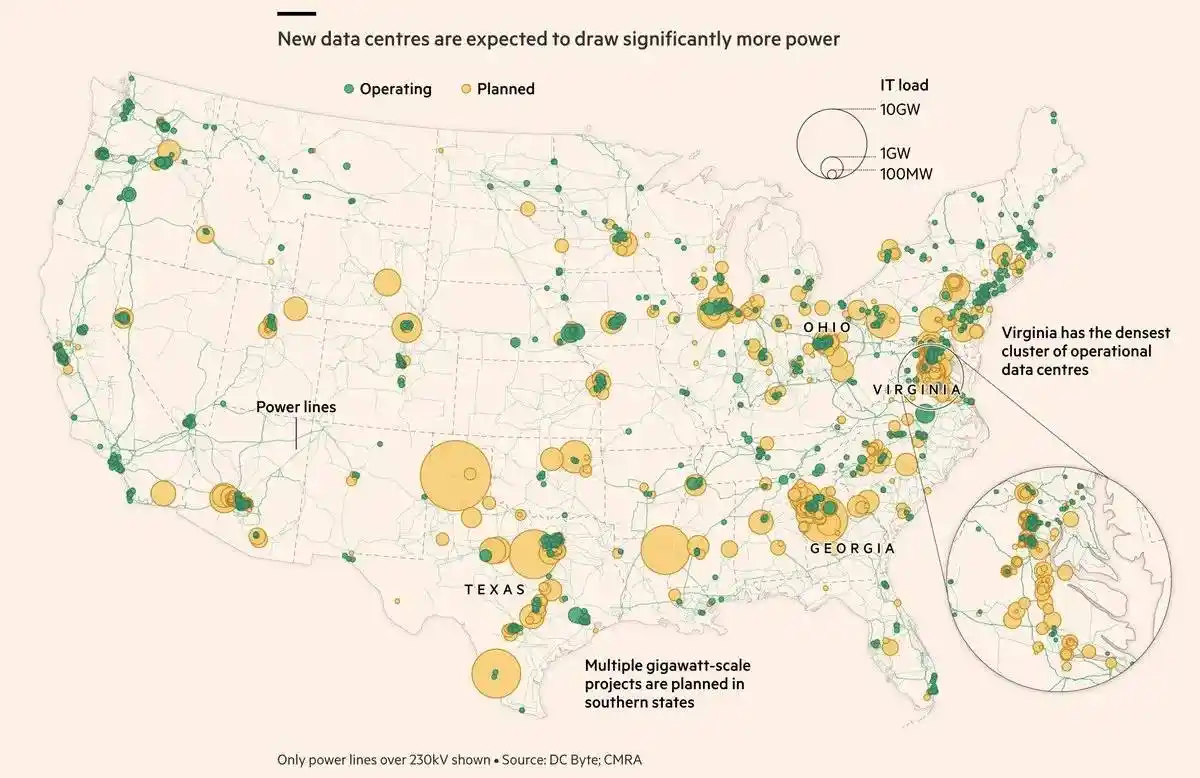

Today, people are becoming billionaires through the expansion of data centers, driving up electricity costs and posing a blackout risk. These data centers occupy vast physical space, but their impact is almost invisible to the average person, with the only perceptible effect being continuously rising electricity bills.

The AI race is an energy race, not a computational power race. As The Financial Times wrote:

"In the competition of global superpowers, AI may be set back by aging power grid infrastructure and insufficient power capacity."

Source: Financial Times

The Financial Times also reported that OpenAI's partners have already incurred $100 billion in debt for building AI computational power. This is worrisome because debt is where things become dangerous. The dot-com bubble was primarily an equity collapse, meaning there wasn't a complex web of debt relationships. But once you get into a debt issue, things can quickly become very tricky.

The U.S. has also decided to sell some of Nvidia's top chips to China in exchange for soybeans and a 25% kickback. As the U.S. Department of Justice stated:

"The nation that controls these chips will control AI technology; the nation that controls AI technology will control the future."

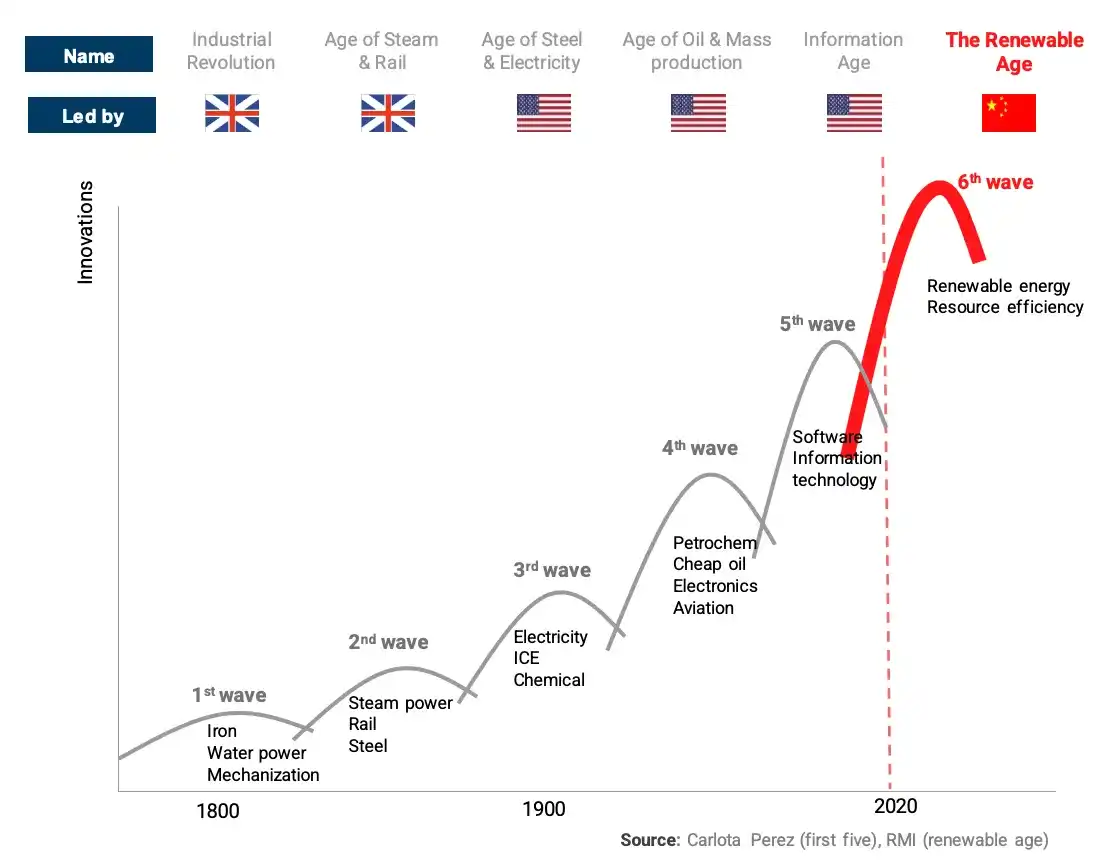

So, you know, no big deal. The Financial Times reported that the U.S. is losing the AI race, "with many U.S. companies, including Airbnb, becoming loyal followers of fast and cheap Qwen." They also posed a question: "Can the West catch up with China?"

The chart below is crucial—when we talk about the future, we often see the U.S. as the top player among global superpowers, but China is investing in the key factors necessary for AI success—energy. Meanwhile, the U.S. is going in the opposite direction.

Source: Phenomenal World

Barclays Bank estimates that by 2025, over half of the U.S. GDP growth will come from AI-related investments. People have come to realize that we are betting the economy on something not truly promising much, like "hey :) this thing will take your job :) now it can even do art :) maybe it will make some people very rich, but your electricity bill (this is already changing voter attitudes) will go up. And, China might win. Plus, suicide is also a breach of service terms."

Almost all young people are very concerned that AI will take away their jobs. MIT's Iceberg Index estimates that about 12% of U.S. wages come from work that AI could do more cheaply today, but only 2% of jobs are currently automated. This capability already exists, it just hasn't been fully deployed yet.

How can you trust a system that seems indifferent to what will happen to you in the future?

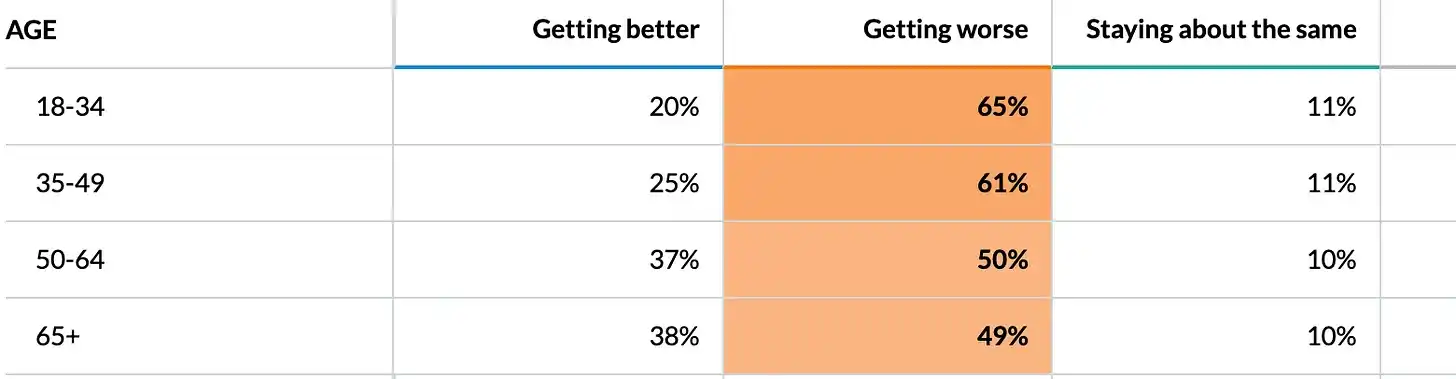

Source: Harvard Youth Opinion Poll This may partially explain why nearly 40% of Americans aged 50 and older believe the economy is "getting better," while most Americans aged 18 to 49 believe the economy is "getting worse." These are two very different economic worlds. The older generation is largely shielded from the impacts of AI and housing, while the younger generation is directly facing these threats.

Source: Civiqs

Adam Millsap wrote an interesting article exploring "Total Boomer Luxury Communism." This concept roughly refers to the older generation "hoarding opportunities and resources, while younger people struggle to buy homes and support the generous social security and healthcare benefits expected by the wealthiest boomer generation." This intergenerational tension will only intensify with the development of medical technologies for extended longevity and resource scarcity.

So, what should people do? With AI taking jobs, policies increasingly catering to the elderly, everything seems full of uncertainty. How should we move forward into the future?

Gambling?

Kalshi's Co-CEO Tarek Mansour recently stated, "Our long-term vision is to financialize everything and turn any disagreement into a tradable asset."

Financialize everything? Could every disagreement, every uncertainty, every future outcome—all become bets? This is truly an extreme extrapolation of Marx's logic of commodity fetishism. When every interaction becomes a transaction, every viewpoint becomes a tradable asset, achieving unity becomes exceptionally challenging.

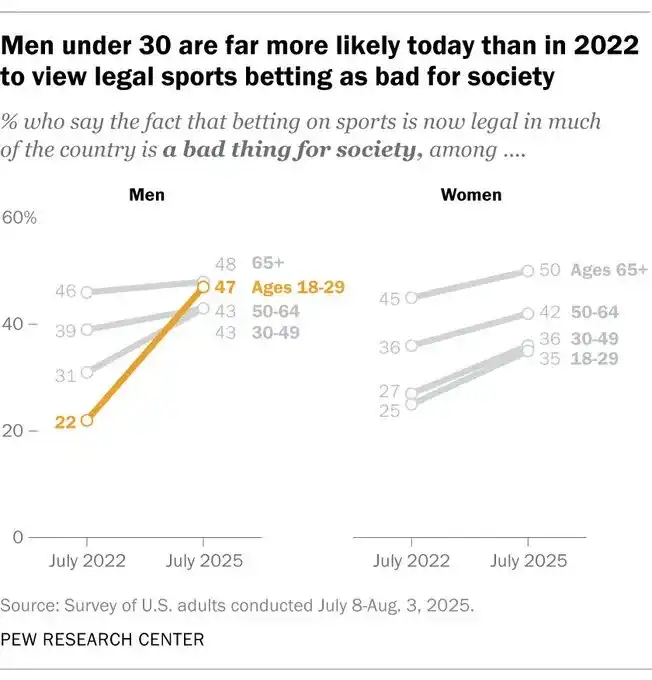

Gambling has become one of the few activities that can provide an immediate return, even life-changing. Living near a casino increases the likelihood of developing a gambling problem. And when you live in your phone, with the casino brought right to you, you can imagine what might happen. But the truth is, no one really wants that kind of life. As the image below shows, this is the truly depressing aspect of the "casino economy"—no one wants it.

Attention is monetized, engagement is optimized, risk is securitized; everything looks like a con. As Whitney Curry Wimbish wrote in The American Prospect and as Emily Stewart mentioned in Business Insider, layers of middlemen extract value, with little real oversight or protection. Some might say, "Well, clearly the market has spoken, and that preference is for people willing to spin the wheel of fortune." But I don't know how to respond.

As the labor market tightens, upward mobility stalls, wealth concentrates at the top and becomes increasingly out of reach, gambling seems to become a rational response. In this structure, people lose a sense of purpose and meaning (see Viktor Frankl, save us), and that is when the problem starts to fester.

Decreased cognitive bandwidth + ubiquitous extraction system = rational economic paranoia. People feel they are being deceived because, indeed, they are often deceived. When the traditional pathways become unpredictable, people turn to the "ladder of narratives"—such as online communities, aesthetic categories, etc. These become ways of understanding uncertainty. The debate over the "14,000-dollar poverty line" is a case in point. People's reactions are about identity and experience, and whether their worldview can be understood by others. These reactions are not all rational, but they do exist.

When values diverge and the common ground weakens, collective solutions become structurally impossible. Even with a broad consensus—no one really wants the 'casino economy'—we still cannot coordinate to prevent it because we cannot agree on what 'preventing it' should look like or who should have the authority to make it happen.

Over the past 70 years, the United States has been built on a simple covenant: provide growth, and people will tolerate everything else. But this year, as I walked 40 weeks on the road, the most consistent feedback I heard from people of different ages, regions, and income levels was that the basic trajectory of life no longer makes sense. While these are anecdotal pieces, they are the most common theme people bring up with me when they take a moment to talk—their concerns. They are worried not only about their financial well-being but also about the entire future.

Part Four: Trust

We are in the midst of such a complex crisis: economic pressures reduce cognitive bandwidth, the decrease in bandwidth fosters exploitative behavior, and exploitative behavior exacerbates economic pressures. Pressure and overload together erode trust, the loss of trust hinders cooperation, and the failure of cooperation prevents problems from being resolved, and unresolved problems further deepen the crisis.

This is not a problem that can be solved by a single policy lever. When traps exist at the intersection of multiple fields like housing, AI regulation, and media literacy, you cannot solve it just by "fixing housing" or "regulating AI" or "improving media literacy." Economic deterioration and cognitive collapse are mutually reinforcing, and they have destroyed the institutional capacity and social trust needed to address these issues.

That sounds terrible! But breaking this cycle does not require solving all problems at once. We need to identify the most actionable linkages and recognize that improving one part will weaken the trap in other aspects.

Directly reduce economic pressure—make the Baumol sectors (like education, healthcare, etc.) affordable again (I know, that's too simple, right). If people have more breathing room economically, their cognitive bandwidth will increase. We all know this. More bandwidth means less susceptible to exploitation and fraud. Less vulnerability means better decision-making ability, and better decision-making ability means less economic pressure.

Directly regulate exploitative behavior—prohibit or strictly limit business models that profit from obfuscation and cognitive overload. Kalshi wants to financialize everything? We can say "no"! We can ban prediction markets on elections. It's all about incentives. If we can regulate physical casinos, we can very well regulate digital ones.

Making the Benefits of AI Clear — Currently, people's experience with AI is "your electricity bill is going up, and ultimately, it will take away your job." If AI is to drive growth, that growth needs to be tangibly beneficial to ordinary people's lives — such as lowering medical costs through diagnostic tools, cheaper goods, and more time.

All of this is not easy, even hard to imagine. But there is hope. You don't need to solve all problems at once. This requires affordability (I hear the "affordability journey" has just begun), national governance capacity, some friction, and an understanding of "humanity" in a tech-filled world. There is also a seemingly simple but actually daunting task — eradicating crony capitalism and establishing some common sense of reality. As I was on a cross-country flight, the internet went out, just hours after the person next to me coughed into the air. I was madly typing away, doing all sorts of "very important work," like writing this newsletter. We were all typing in the dark, sending emails, busy on Slack. When the internet went out, we started opening the plane's windows. Outside was one of the most beautiful sunsets I've ever seen. There is something to be said in all of this.

Finally, I really liked this line from a recent interview with Kahlil Joseph:

"There's a famous story that Jimi Hendrix tuned his music for a transistor radio because that was what soldiers were listening to, so he tuned his work for the FM radio. He wasn't thinking about someone listening to his music on a thousand-dollar stereo system. That always stuck with me — meeting people where they are."

Thank you.

Footnotes:

<1> The University of Michigan Consumer Survey transitioned from random dial surveys to online surveys in mid-2024.

<2> Netflix and Paramount are competing to acquire Warner Brothers. According to The Wall Street Journal, "David Ellison reassured Trump administration officials that should he purchase Warner, he would overhaul CNN, a frequent target of President Trump."

<3> Reflections on the impact of the internet are starting to spark strong reactions. Roisin Lanigan wrote an article titled "The Next Status Symbol is an Offline Childhood," a very straightforward title. More and more similar articles are emerging, such as P.E. Moskowitz's "The Internet is Destroying Our Memory and History," exploring the pros and cons of the internet.

<4> Cracks in the financial markets. Applied Digital faced difficulties in selling bonds, having to offer a 10% high yield to attract buyers. They provide data center services for CoreWeave, which in turn provides data center services for Nvidia and OpenAI.

<5> Kalshi is facing a nationwide class-action lawsuit, with plaintiffs alleging it operates as an "illegal sports betting platform." The lawsuit claims that Kalshi "deceived" customers into believing they were betting against other consumers when, in reality, they were betting against the house (Kalshi). Additionally, a Nevada court ruled that Kalshi is not exempt from state gambling regulations, putting its business model under significant pressure. An analysis by Bloomberg shows that Kalshi's fees are remarkably high, to the point that in most cases, users might be better off using FanDuel directly.

You may also like

From 0 to $1 Million: Five Steps to Outperform the Market Through Wallet Tracking

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

From 0 to $1 Million: Five Steps to Outperform the Market Through Wallet Tracking

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Earn

Earn