Key Market Insights for November 5th, how much did you miss out on?

Featured News

1. GIGGLE Continues Surge with a Short-Term Breakthrough to $143, 24-hour Gain Expands to 178%

2. MMT Surges Briefly Touching $1.5

3. Bitcoin Rebounds Breakthrough $102,000, 24-hour Loss Narrows to 4.7%

4. U.S. Government Enters 36th Day of "Shutdown," Setting a New Record for the Longest Ever

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

Here is the translation of the original content:

[PEPE]

Today, discussions around PEPE mainly focused on significant market activities and notable purchases. A new Chinese whale has been actively acquiring Plush Pepe NFTs, spending millions of dollars to support the floor, while another noteworthy purchase was Plush Pepe #1442, transacted at a price of 9718 TON. Additionally, a clever whale who previously profited from PEPE made a substantial investment in ASTER. Despite the overall bearish sentiment in the crypto market, PEPE remains a hot topic due to these high-profile transactions.

[STREAM]

STREAM Finance took center stage today due to a major loss caused by an external fund manager, resulting in $93 million losses, leading to deposit and withdrawal freezes and a drop in the value of its stablecoin xUSD. This event has raised concerns about the wider DeFi ecosystem's exposure to STREAM's financial troubles, with other protocols (such as Morpho, Euler, and Silo) potentially at risk of contagion. This situation sparked debates on the importance of risk management practices and operational transparency in DeFi.

[MORPHO]

Today, the discussion around MORPHO mainly focused on the aftermath of the Stream Finance crash, leading to a strict scrutiny of the Curator model used by Morpho. This event highlighted the risks associated with high-yield vaults and the importance of risk management in DeFi. Despite the negative sentiment, some tweets defended Morpho's isolated market model, emphasizing that it prevented a wider spread. The discussion also involved the need for Curators to have better transparency and accountability, as well as the potential for DeFi to responsibly scale.

[LINK]

Today, Chainlink (LINK) garnered attention due to several significant announcements and developments. The launch of Chainlink's Chainlink Runtime Environment (CRE) and Chainlink Confidential Computing was highlighted as a key innovation enabling private smart contracts and enhancing on-chain finance. UBS successfully executed the first on-chain tokenized fund redemption using Chainlink's Digital Transfer Agent, marking a milestone in blockchain infrastructure. Additionally, Tradeweb partnered with Chainlink to on-chain publish U.S. Treasury data through DataLink, further advancing institutional tokenization efforts. Despite these positive developments, there are concerns about a Chainlink oracle failure leading to a $1 million vulnerability in the Moonwell protocol.

[MOMENTUM]

Momentum (MMT) received significant attention today as it was listed on several major exchanges, including Binance, Bybit, and OKX. The token's launch was marked by various trading opportunities, airdrop distributions, and investor protection features. The community is excited about the project's potential, with discussions highlighting its innovative DeFi mechanisms such as the ve(3,3) model and strategic partnerships. The token's performance, trading incentives, and future growth prospects are key topics driving the discussion around MMT.

Featured Articles

1. "Wall Street Continues to Sell Off, How Much Further Will Bitcoin Drop?"

In the first week of November, the sentiment in the crypto market was very bearish. Bitcoin has plummeted to a new low below the "10.11" crash, failing to hold the $100,000 mark and even dropping below $99,000, hitting a six-month low, while Ethereum fell to a low of $3,000. The total 24-hour liquidation amount exceeded $2 billion, with long positions losing $1.63 billion and short positions being liquidated for $400 million.

2.《Why Does the Bitcoin Price Surge When the US Government Shuts Down?》

The US government shutdown has officially entered its record-breaking 36th day. In the past two days, the global financial markets have tumbled. The Nasdaq, Bitcoin, tech stocks, Nikkei Index, and even safe-haven assets such as US Treasuries and gold have not been spared. As market panic spreads, Washington politicians continue to bicker over the budget. Is there a connection between the US government shutdown and the global financial market downturn? The answer is emerging.

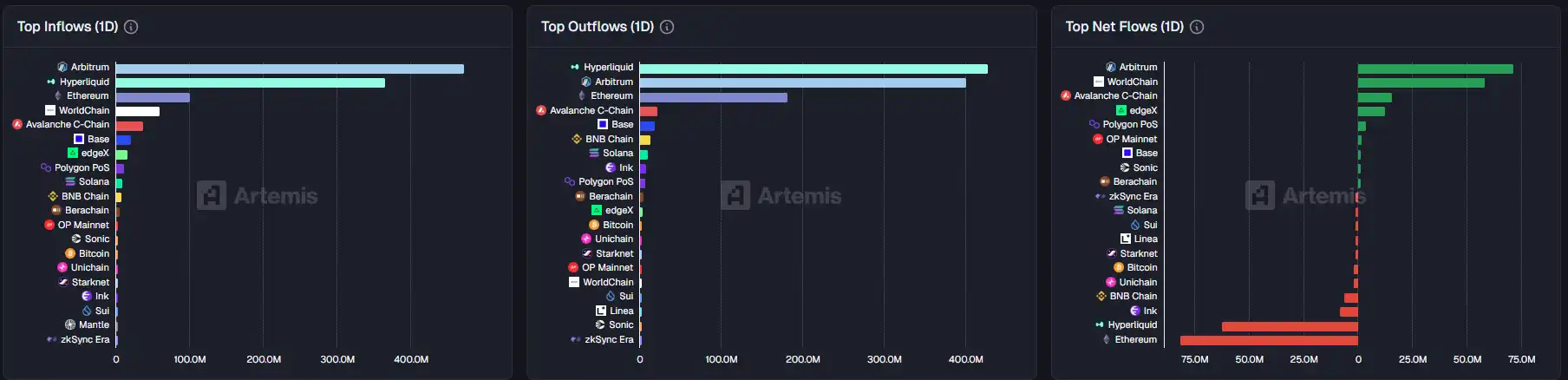

On-chain Data

On-chain Fund Flow Data for the Week of November 5

You may also like

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…

South Korea Broadens Crypto Market Investigation Following Bithumb’s $44 Billion Bitcoin Error

Key Takeaways South Korea intensifies scrutiny on cryptocurrency exchange operations after Bithumb’s significant Bitcoin transaction error. Regulatory bodies,…