How does MegaETH unlock Web2 performance to achieve millisecond-level response times?

Original Article Title: Web2 Performance Parity Unlocked: The MegaETH Approach

Original Article Author: @deelabsxyz, web3 Research Institution

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: This article introduces the scalability of the MegaETH ecosystem and its future potential. It highlights MegaETH's ultra-high performance, promising 100,000 TPS and low latency to accommodate DeFi, gaming, and other high-demand applications. The article also discusses the comparison with Visa and high-frequency trading, analyzing the challenges and opportunities of blockchain's future needs. Through its unique architecture and mainnet plan, MegaETH could be a breakthrough in blockchain scalability, especially in addressing existing performance bottlenecks.

The following is the original content (slightly reorganized for better readability):

Introduction

If you've ever played online games like "Call of Duty," you know that millisecond-level latency can determine victory or defeat. Imagine being the last survivor on your team, with only one enemy left on the other side. Adrenaline rushing, you aim for a headshot at a crucial moment, but in an instant, the situation reverses — you are defeated by the opponent. This is not a matter of luck but because the opponent's network latency is lower than yours.

Now, in a different scenario, suppose you are a high-frequency trader, with the system analyzing market data in real-time. Suddenly, a tech giant announces better-than-expected quarterly earnings, and the stock price surges rapidly. Your algorithm instantly captures the trend, and in less than a second, the price has risen by 2%. You quickly close your position to lock in profits.

What do these two examples have in common? They both belong to Web2's real-time applications, whether in gaming or trading, requiring millisecond-level response times. Web2 achieves high-speed data flow through a centralized server architecture, where information runs "synchronously" between devices and servers with almost no latency.

So, can blockchain achieve the same level of performance? Decentralized systems have always faced a core bottleneck: slow block times, the need for node consensus, leading to inherent delays and computational overhead. Especially in environments like the Ethereum Virtual Machine, transaction processing efficiency is often limited. These issues significantly impact the user experience of Web3 applications, making it difficult to compete with Web2 in terms of speed and latency — at least until recently.

Scalability Bottleneck

To address issues such as low throughput and slow transaction processing speed, Layer 2 scaling solutions have emerged. Layer 2 solutions like Optimism, Arbitrum, and Base aim to significantly improve the network's efficiency and scalability by moving a large amount of computation and transaction processing off L1 (Ethereum mainnet).

In Layer 2 solutions, transactions submitted by users first enter L2's centralized sequencer. The sequencer is responsible for collecting, ordering, and packaging transactions, then executing the transactions and updating L2's state. Subsequently, L2 submits the compressed transaction data to L1 to ensure security and for final confirmation. Only after L1 validation is completed will the L2 state be updated, and the transactions will be considered finally confirmed.

Although Layer 2 solutions have enhanced Ethereum's scalability, there is still a delay in transaction finality. This is because Rollups rely on the security of the Ethereum mainnet and require regular submission of commitments (such as fraud proofs or validity proofs) to maintain trust. These processes mean that transactions must wait for mainnet confirmation to be finally settled, introducing additional latency.

Take Optimistic Rollups, for example; they have a challenge period of up to 7 days to resolve transaction accuracy disputes, significantly slowing down the final confirmation speed of transactions. While zk Rollups speed up settlement through validity proofs, this also significantly increases the computational cost. Even centralized Layer 2 solutions cannot completely break away from these security mechanisms tied to L1 without affecting decentralization and security.

Furthermore, Layer 2 solutions often operate in isolation, leading to fragmented liquidity and increased complexity in inter-chain interactions. When moving between different Rollups or back to the main chain from L2, cross-chain bridges are required, introducing additional costs, delays, new trust assumptions, and security risks.

The end result? The total transaction processing capacity of all Layer 2 solutions is only about 270 transactions per second, far below the performance standards of Web2 and still inadequate to meet the demands of large-scale applications.

Solving the Scalability Issue

In addition to Layer 2 solutions, Ethereum proposed a new approach to improving the consensus mechanism in September 2023—SSF (Single-Slot Finality). This scheme combines BLS (Boneh-Lynn-Shacham) signatures and Supercommittees to achieve a 75x speedup in final confirmation, reducing transaction confirmation time from the current 15 minutes to a single 12-second slot.

To understand the core mechanism of this solution, we can break down its key components.

BLS Signature

A BLS signature is a cryptographic technique that can aggregate multiple signatures into a single compact signature. Specifically, each validator will sign the block, and then all signatures will be aggregated into one overall signature.

The efficiency gains of this mechanism are tremendous: validators do not need to process millions of signatures individually but can instead complete consensus validation in one go. Thanks to this aggregation method, even a validator network of 1 million nodes can complete signature processing within a standard 12-second slot.

Supercommittees

SSF does not require all validators to vote on each block but instead employs a supercommittee mechanism. In each 12-second slot, a small subset of validators is randomly selected to vote. For example, out of 1 million validators, only around 125,000 may be chosen as supercommittee members for that slot to vote and confirm the current block.

This approach significantly reduces network overhead: the amount of data to be transmitted and processed decreases, the voting and signature aggregation process becomes faster and more efficient, and system security and reliability remain unaffected.

Through the efficient aggregation of BLS signatures and the voting optimization of supercommittees, SSF has achieved a significant performance improvement, bringing Ethereum closer to the transaction confirmation speed of Web2.

While SSF offers a theoretical breakthrough, its architecture is currently too complex to be practically deployed. Ethereum's current computing power and speed are not sufficient to support the implementation of this solution.

However, an alternative solution for high-performance blockchains is emerging—MegaETH (@megaeth_labs). MegaETH has adopted a new strategy aimed at breaking through scalability bottlenecks. This article will delve into MegaETH and assess whether it can become a viable solution to address blockchain performance issues.

MegaETH: Redefining L2 Design

MegaETH has completely disrupted traditional L2 design, built specifically for extreme performance, aiming to achieve sub-10ms block times and over 100,000 TPS, enabling blockchain applications to have speed comparable to centralized systems for the first time.

Why Does the Blockchain Ecosystem Still Need New L2 Solutions? The reason is that, despite the numerous innovations brought by existing L2 solutions, such as new lending models, they still lag far behind centralized systems in terms of data processing speed.

The technological breakthrough of MegaETH will significantly improve blockchain performance, making it a true alternative to centralized systems and prompting people to rethink the potential of decentralization in more complex application scenarios.

Architecture Overview

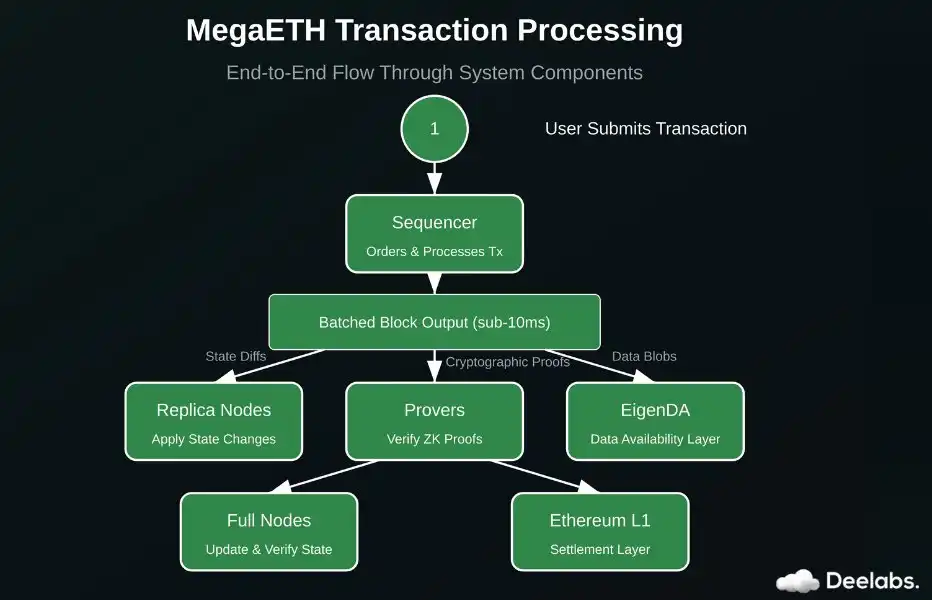

Unlike traditional L2 solutions that rely on a single centralized sequencer to manage transaction sequencing, MegaETH has adopted a set of specialized node architecture to maximize system efficiency. The current MegaETH architecture consists of four core roles:

· Sequencers

· Provers

· Full Nodes

· Replica Nodes

Sequencers

In the MegaETH system, sequencers are core nodes responsible for receiving, sequencing, and processing user transactions.

· High-Performance Hardware Support: MegaETH's sequencers run on high-performance servers with multi-core processors and large memory capacity, avoiding the latency caused by traditional L2's reliance on SSDs or other storage devices.

· Optimized State Trie: Using efficient memory and I/O design, it can manage data at the TB level even under memory constraints, avoiding additional I/O overhead. Compared to traditional disk storage-based solutions, this design improves state access speed by 1000 times.

· Parallel Processing: Leveraging multi-core CPUs, each core can independently perform tasks, supporting parallel processing of EVM transactions and compressing block processing time to less than 10 milliseconds, comparable to the latency level of online multiplayer games.

Summary: More CPU cores → Higher parallelism → Faster transaction processing speed.

When users send transactions to the MegaETH network, sequencers are responsible for determining transaction execution order and completing processing. After transaction execution, sequencers generate blocks containing transaction data and state changes (i.e., state diffs) and send this information to replica nodes or full nodes for synchronization among different types of users.

Full Nodes

In MegaETH, Full Nodes play a role similar to traditional blockchains, storing the entire blockchain state and re-executing every transaction provided by the orderer to ensure ledger consistency.

Additionally, Full Nodes also utilize zero-knowledge proofs to perform additional block validation. The zk proof, generated by Prover Nodes, ensures transaction correctness, enhancing security and data integrity.

Replica Nodes

Unlike Full Nodes, Replica Nodes do not store the full blockchain state or re-execute transactions. Instead, they rely entirely on zero-knowledge proofs provided by Prover Nodes.

· Replica Nodes receive state delta data from the orderer via a peer-to-peer network and apply it directly to their local state replica to stay in sync with the network.

· They indirectly confirm block correctness without processing transactions, significantly reducing computational costs and improving synchronization efficiency.

This architecture allows MegaETH to support a more lightweight node deployment, increase decentralization, and maintain network efficiency.

Prover Nodes

In traditional blockchains, nodes need to store the complete state (e.g., account balances) and validate transactions to ensure correctness.

MegaETH employs stateless validation where Prover Nodes do not need to store the full state. Instead, they rely on zk proofs and state delta data provided by the orderer to validate transactions. This significantly reduces storage requirements and improves block confirmation efficiency.

EigenDA: Decentralized Data Availability Layer

MegaETH uses EigenDA as a decentralized data availability storage layer to ensure all transaction-related data is always available for any node in the network to verify or recover.

Data Blobs: MegaETH's orderer compresses transaction history into data blobs, which are further divided into smaller data fragments for easier storage and distribution.

Data Distribution: These data fragments are assigned to EigenDA operators, nodes that stake ETH in the EigenLayer to secure the network. These operators are responsible for storing the data and providing data retrieval services when needed.

Data Recovery and Verification: Any user or node that needs to validate MegaETH transaction data can obtain the relevant data from EigenDA operators to ensure the integrity of the blockchain.

On March 21, 2024, the MegaETH public testnet was officially launched, demonstrating an impressive performance of 20,000 TPS while maintaining a block time of only 10 milliseconds, significantly outperforming existing blockchain systems.

This carefully designed multi-layer architecture, combined with EigenDA's data storage capabilities, brings MegaETH closer to its true real-time blockchain performance goals.

MegaETH Architecture Workflow

In the MegaETH network, the process from the sorter to final transaction confirmation goes through multiple stages, with each component carrying specific responsibilities to ensure the efficient operation of the blockchain.

1. Sorter processes transactions and generates blocks

The sorter plays a crucial role in the MegaETH ecosystem, responsible for the following tasks:

· Receiving user transactions and determining their order.

· Processing transactions, executing EVM computations, and updating the blockchain state.

· Creating blocks, which include:

State transition data: Changes in state after transaction execution, such as account balance updates.

Cryptographic proof: Used to verify the correctness of state transitions.

2. Provers validate blocks

Upon receiving a block, provers perform the following steps:

· Receive and parse the block, extract transactions, state transition data, and cryptographic proof.

· Run cryptographic algorithms to check the proof, validate if transactions comply with MegaETH rules, ensuring:

State transition data has not been tampered with.

State transition data aligns with transaction logic.

The proof itself is cryptographically valid.

· Confirm the block: Once a sufficient number of provers complete validation, the block is considered finally confirmed and the confirmation data is broadcasted to the entire network.

Key Optimization Points:

· Validators do not need to store the full state; they only need to verify the cryptographic proof provided by the sequencer, reducing storage requirements and computational costs.

· Validation is faster than recomputation because validators only need to check the cryptographic proof rather than perform all transaction computations.

· Blocks can be processed in parallel regardless of the order in which they were created. For example, a validator can first validate the 10th block and then the 5th block, as long as they have the corresponding state transition data and cryptographic proof.

3. Ensure Data Propagation to the Entire Network

Once a block is validated by a sufficient number of validators:

· Its confirmation data is sent to full nodes and archival nodes within the MegaETH network.

· Full nodes store the complete blockchain state and re-execute transactions for final confirmation.

· Archival nodes rely on the results from validators, directly applying state transition data to stay synchronized.

· The finally confirmed block is formally added to the MegaETH main chain.

This architecture allows MegaETH to maintain high performance and decentralization, optimize computational and storage requirements, and provide a fresh perspective on blockchain scalability.

Since MegaETH processes transactions outside the main Ethereum network, it must ensure that transaction data is publicly visible to all network participants to ensure data accuracy and uphold the decentralization principle. This is akin to providing proof of operation for the entire ecosystem.

In MegaETH, these correctness proofs include block data that meticulously records completed transactions and their impact on the blockchain state.

Why Does MegaETH Adopt Two Types of Nodes?

Most nodes in the MegaETH network are archival nodes, primarily catering to application developers and infrastructure providers. They are optimized to support frontend applications, reduce hardware requirements, enhance user experience, and enable more people to participate.

At the same time, full nodes remain crucial, serving advanced users such as bridge operators and liquidity providers who prefer independently validated data. Compared to archival nodes, full nodes require higher hardware specifications to stay in sync with the sequencer.

Product Strategy

MegaETH is currently not yet released on the mainnet, so widespread adoption has not been achieved, but it has already attracted community attention and support.

Today, MegaETH has become one of the most talked-about projects in the industry. The team has put in tremendous effort and achieved significant success in building trust and visibility. Here are the key strategies behind their success.

Attracting Top Investors

The team successfully completed a seed funding round, raising $20 million, with investors including Dragonfly, Robot Ventures, Vitalik Buterin, and other well-known institutions and individual investors.

MegaETH's association with Vitalik Buterin has made it a technically ambitious project and aligned with Ethereum's long-term vision, naturally attracting the Ethereum community's attention. This has not only enhanced the project's reputation but also laid a solid foundation for its future development.

Community-Driven Fundraising Strategy

MegaETH conducted a public sale on the Echo platform. Echo is a platform designed specifically to attract angel investments, allowing investors to team up and collectively support early-stage promising crypto projects. Ultimately, MegaETH raised $10 million in less than three minutes, becoming the fastest project to secure funding on Echo since its beta launch.

The highlight of this round of funding lies in the composition of participants. MegaETH did not follow the traditional VC approach of seeking high valuation investments from venture capital firms but redesigned the process to give community members an equal opportunity to invest alongside large institutional investors.

This strategy proved highly successful, attracting a total of 3200 new investors, with an average investment of $3000 per person. This not only raised funds but also built a broad and highly engaged supporter base.

Largest Transaction on the Echo Platform (MegaETH Ranked First)

This funding structure combined equity with token options, ensuring participants' long-term interests, similar to MegaLabs' $20 million seed funding round completed in June of this year. The valuations of both rounds of funding exceed $1 billion.

This model not only helped MegaETH gain genuine community support, but also enabled the community to be deeply involved in ecosystem development from the beginning, forming a clear and sustainable incentive mechanism to ensure long-term user engagement.

Fluffle NFT Series

MegaETH further strengthened its community-oriented strategy by launching the Fluffle series NFT—consisting of 10,000 unique soulbound NFTs (non-transferable), each valued at 1 ETH.

The uniqueness of this series lies in representing at least 5% of the MegaETH network share, with this proportion set to increase as the project progresses. This mechanism not only promotes long-term engagement but also enhances community loyalty.

The first batch of 5,000 NFTs specifically rewards early supporters who contributed to the MegaETH ecosystem, such as driving core protocol development or building the local community. Prior to the official minting launch, 80,000 eligible addresses have been whitelisted.

The second batch of 5,000 NFTs will be released in a few months, aiming to incentivize those who continue to enhance the MegaETH ecosystem through social interaction and on-chain contributions, allowing them the same participation opportunities.

Mega Mafia Accelerator

MegaETH had long realized that mere financial investment does not guarantee community loyalty. Therefore, the team not only provided funding support to developers but also launched the Mega Mafia Accelerator program.

This program aims to support projects that can promote blockchain ecosystem development, incentivizing new ideas and technological advancements. Selected teams not only receive resource support but also collaborate closely with the core team and advisors, participating in offline events and industry summits together.

Currently, the total funding raised by projects incubated under the Mega Mafia program has exceeded that of MegaETH itself, and the program is actively supporting 15 teams (full list available in official information). In addition, MegaETH is building an ecosystem beyond the accelerator itself.

Ecosystem Overview

Through a precise and well-thought-out strategy, MegaETH has successfully attracted multiple high-quality projects. Its ecosystem spans various fields, including trading platforms, DeFi solutions, games, entertainment, and more.

The ecosystem was launched in early 2023 and continued to expand in 2024. By the end of 2024, with the introduction of the Mega Mafia Builder program, the first batch of projects started to land. Today, the MegaETH ecosystem has gathered more than 45 active teams and is growing steadily.

The MegaETH ecosystem is currently mainly composed of projects in the DeFi and entertainment sectors, including gaming and NFT projects. Projects in these sectors involve high-performance applications that require robust bandwidth and low latency, which are precisely MegaETH's strengths.

While DeFi remains the most popular sector in the crypto industry, with the most applications and serving as the economic core of various ecosystems, the situation is different for the gaming industry.

As a comparison, we can look at the Arbitrum ecosystem. It includes over 1,000 projects and is one of the most well-known and widely used L2 solutions on Ethereum today.

In the Arbitrum ecosystem, DeFi projects have become the focus, with approximately 440 projects, while infrastructure projects (including tools) account for about 318 projects, totaling around 72% of the ecosystem. This highlights its cost-effective approach. Entertainment projects, such as games and NFTs, only make up 14%, a lower percentage that also has its rationale.

The rise of GameFi began in 2021, but just one year later, the market experienced a significant slump. The main reason for this collapse was the disappointing user experience: the quality of games lagged far behind projects from the Web2 era. Players often complained about poor immersion, sluggish performance, and unresponsive gameplay, and the introduction of L2 solutions failed to reverse the situation.

Ecosystem Projects' Uniqueness

Due to MegaETH's unique architecture, it provides a foundation for equally unique projects. To better understand this, let's take a deeper look at a few representative projects selected for their widespread recognition and unique architectural design.

GTE

GTE (@GTE_XYZ) is a decentralized trading platform designed to enhance existing DEXes by combining the characteristics of centralized exchanges (CEX) and decentralized exchanges.

GTE focuses on reducing transaction latency, providing fast and efficient trading comparable to CEX, while still adhering to the core principles of decentralized exchanges—user asset control, transparency, and enhanced security.

The platform provides a comprehensive solution by integrating the entire trading cycle into one ecosystem—from token creation to supporting spot and margin trading. This allows users to handle all transaction-related tasks without switching between different services.

To achieve fast transactions, GTE has chosen MegaETH as its foundation, which not only processes transactions quickly but also significantly reduces gas costs, making trading on GTE more cost-effective than on most other DEXs.

Pump Party

Pump Party (@pumppartyapp) is a decentralized application aimed at creating an interactive real-time game show experience. Users can participate in live mini-games and compete for token rewards.

The platform operates as follows: Users register via email or social media, view the show schedule, and join the live broadcast. During the broadcast, the host conducts games in which users can participate.

At the end of the game, the system selects a winner based on the user with the highest score, and the token rewards are automatically added to their account.

The project positions itself as a "crypto app for the masses," meaning it is primarily targeted at those unfamiliar with blockchain technology. In a sense, it has the potential to become a blockchain version of "Twitch."

Teko Finance

Teko (@tekofinance) is a lending protocol that claims to be the first to offer real-time low collateral loans. Its main goal is to overcome the limitations of traditional on-chain lending, such as high collateral requirements and performance bottlenecks, elevating lending services to near traditional financial levels.

Users deposit assets into the protocol as collateral, and the protocol assesses the assets' liquidity and volatility through a built-in oracle. Based on the assessment, users receive a loan in the form of tokens, which may have a value lower than the collateral as the protocol includes risk management mechanisms. These tokens can be used within the ecosystem, repaid with interest, with the interest dynamically adjusted based on market conditions.

By integrating with MegaETH and utilizing the built-in oracle, Teko dynamically updates asset prices and market conditions in real time. This ensures accurate risk assessment and enables the protocol to adapt to market changes instantly. Therefore, Teko stands out among other lending protocols, becoming a competitive choice.

Future Outlook

Looking ahead, one thing is clear: the ecosystem will further expand, attracting many new applications. Their stability and feasibility will test whether people and applications truly need 100,000 TPS (transactions per second).

For example, Visa's peak transaction processing capability reaches 56,000 TPS, handling transactions for millions of users worldwide, which has been working well. Now, imagine if there are 1 billion devices, each conducting a transaction every 10 seconds, totaling 100,000 TPS. However, not all devices will be operating simultaneously, alleviating the system's burden.

Meanwhile, the GameFi market is likely to find new vitality, breaking through the current barriers faced by blockchain. Consider an RPG game on the blockchain, with 20,000 players online simultaneously: every explosion, item purchase, or shot is considered a transaction. Multiply that by thousands of simultaneous actions, and the result could be substantial, even surpassing 100,000 TPS.

Now, look at high-frequency trading (HFT), a trading strategy that relies on executing thousands or even millions of small transactions within a fraction of a second. In HFT, speed is crucial: traders who confirm transactions faster can seize the best market positions, leaving competitors behind. If this speed can be brought to the blockchain, it would be a true breakthrough, propelling the entire industry to new heights.

The reality of these scenarios will become clear by the end of 2025 when the MegaETH mainnet launches, providing an opportunity to validate these ideas.

Conclusion

Many teams have attempted to create high-performance blockchains, but few have succeeded. Currently, all Ethereum Rollup solutions combined handle about 200-300 TPS, with little evidence of demand for higher capacity.

MegaETH has proposed an attractive scaling solution, promising to deliver 100,000+ TPS and sub-10-millisecond block times. This could be the ultimate scaling breakthrough. However, we must remain patient and observe whether such massive blockchain processing power is truly needed and whether MegaETH's user acquisition strategy proves effective.

With the mainnet scheduled to launch by the end of 2025, MegaETH has a significant opportunity to prove its potential. We will soon find out whether it can deliver on its promises, spark user interest, and possibly even bridge the performance gap between Web2 and Web3.

You may also like

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Earn

Earn