2025 Can Ethereum Reach a New All-Time High?

Original Title: Why Ethereum Maximalists Say ETH Will Be the 'Comeback Kid' of 2025

Original Author: Tom Mitchelhill, Coin Author: Tom Mitchelhill, Cointelegraph

Translation: Daisy, MarsBit

Analysts and experts say that AI smart contracts, a series of significant network upgrades, and improvements in the US regulatory environment are among the reasons Ethereum fans are looking forward to 2025.

Ethereum supporters point to AI smart contracts, major network upgrades, increasing institutional interest, and overall regulatory reform brought about by the crypto-friendly administration of the new US President, Donald Trump, as reasons for excitement about 2025.

Infinex founder Kain Warwick said in an interview with Cointelegraph that while Ethereum's performance in 2024 was somewhat lackluster, the asset is like a "compressed spring" ready for a breakout in 2025.

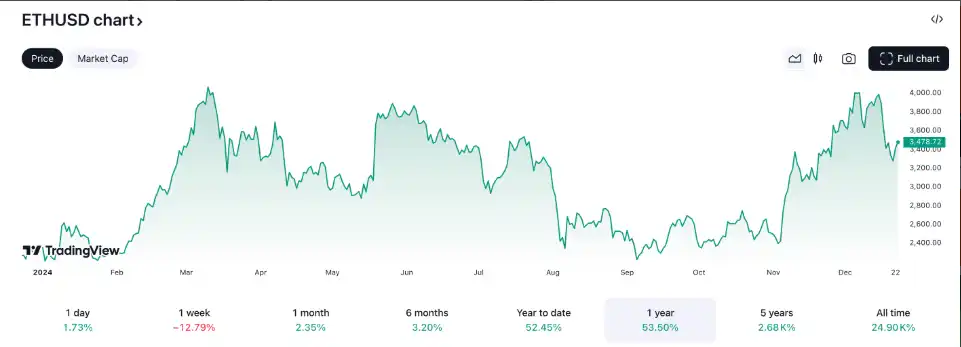

According to TradingView data, as of now, ETH has seen a year-to-date increase of 53.5%, rising from $2,350 on January 1 to the current $3,478.

ETH has posted a year-to-date gain of 53.5%. Source:TradingView

Meanwhile, other major crypto assets including Solana, Cardano, and Ripple's XRP have seen gains of 92.7%, 57%, and 276.5% respectively year to date.

"The longer you press it down, the stronger it bounces back. There are many favorable factors as well as some constraints, but once it breaks through, people will say 'wow,'" Warwick said.

Source:Kain Warwick

He mentioned some Ethereum Improvement Proposals (EIPs) and the user experience improvements brought by these upgrades, seeing them as key turning points for Ethereum and ETH price movements.

「In 2025, I think we will see improvements in account abstraction, significant progress in L2 interoperability, and a substantial enhancement in user experience between L2s.」

Ethereum to Welcome the Pectra Upgrade in 2025

One of the major upgrades eagerly anticipated by Warwick and other Ethereum supporters is the Pectra upgrade—this is the next significant milestone on the Ethereum roadmap, expected to launch in early 2025.

Gaia Regis, Co-founder and CEO of the Restaking platform Byzantine, stated that the Pectra upgrade will fundamentally change the operation of the Ethereum security layer.

「Currently, Ethereum staking mainly relies on liquidity. Essentially, many ETH holders want to participate in staking. This is generally a good thing as more nodes mean more decentralization and higher security,」 she said.

However, Regis explained that Ethereum has now reached a massive scale—communication between over 1 million Ethereum validators—which has started to slow down the network.

「Pectra addresses this by increasing the validator's maximum effective balance from 32 ETH to 2,048 ETH, significantly reducing the required number of validators and alleviating network pressure,」 Regis said.

「Reduced pressure means a faster network, and a better experience for Ethereum users.」

In September of this year, Ethereum core developers decided to split the Pectra upgrade into two main packages. The first Pectra package will introduce a total of eight EIPs, with the most important being EIP-7702, aimed at improving the user experience of wallets and chain abstraction.

「This will make staking cheaper, leading to more participation in staking, thus gradually lowering staking rewards over time. This is why we are extremely bullish on restaking. Many will want to increase their staking rewards by ensuring other networks.」

Trump's Crypto-Friendly SEC Will Be Especially Beneficial for ETH

The Managing Partner of the crypto venture capital firm Masterkey, Saul Rejwan, stated in an interview with Cointelegraph that Ethereum and more "legitimate" projects in the crypto industry, particularly in decentralized finance (DeFi) and decentralized physical infrastructure (DePIN), will benefit the most under the Trump administration and a more crypto-friendly U.S. Securities and Exchange Commission (SEC).

On December 4, Trump nominated the pro-cryptocurrency businessman and former SEC commissioner Paul Atkins to be the next SEC chairman, while the current chairman, Gary Gensler, plans to step down from his position on January 20.

"In a more favorable regulatory environment, DeFi projects on Ethereum will thrive, and areas like restaking only need a little regulatory push to attract institutional investors," he said.

"We expect this new leadership to lower the barriers to entry, making it easier for early crypto entrepreneurs and resilient companies to innovate and succeed."

Stablecoins, Tokenization, and AI Agents

The Chief Investment Officer of Bitwise, Matt Hougan, stated that Ethereum has three key advantages heading into 2025 and expects the asset to see a breakout in the new year.

"Ethereum sits at the center of the three largest trends in the crypto industry: the rise of stablecoins, tokenization, and AI agents. It dominates the market share in these three areas," Hougan said.

He added, "I believe the excitement in these three areas next year will spill over to Ethereum, making it the comeback king of 2025. You can already see this in its recent strong performance and ETF inflows."

Over the past two weeks, Ethereum ETFs have seen $1.5 billion in net inflows, marking one of the largest periods of fund inflows among eight spot ETFs, according to Farside Investors data.

Ethereum ETFs have witnessed over $1.5 billion in net inflows in the last two trading weeks. Source: Farside Investors

Like Rejwan, Houghan also believes that the new crypto-friendly SEC under the leadership of Trump is particularly favorable to Ethereum.

“I am looking forward to lifting the ‘Sword of Damocles’ that has been hanging over the U.S. crypto industry for the past four years. Washington’s new approach will unleash millions of crypto entrepreneurs, many of whom will build killer applications on Ethereum and its layer-two networks,” Houghan said.

“We are entering the golden age of crypto, and Ethereum will be one of the primary beneficiaries of this flourishing. ”

Houghan stated that overall, Bitwise expects ETH to surpass its previous all-time high of $4,878, reaching what he described as a “conservative” forecast of $7,000.

More Layer-Two Networks, Enhanced Staking, and Better DApps

Edu Timmers, Chief Marketing Officer of the crypto company Keyrock and Ethereum supporter, believes that with the launch of new layer-two networks such as Abstract and the Deutsche Bank project, this will enhance the widespread adoption of the Ethereum ecosystem.

Timmers also mentioned that the rise of on-chain perpetual contract protocol Hyperliquid built on Arbitrum recently demonstrates the growth of Ethereum's on-chain dominance. He expressed his expectation that Ethereum and its decentralized applications (DApps) ecosystem will start competing with centralized market leaders like Binance in the new year.

“Projects like Hyperliquid will start competing with centralized players like Binance in 2025, rather than decentralized projects like Uniswap,” Timmers said.

Furthermore, Timmers stated that Ethereum's restaking is another area worth paying attention to in 2025, calling it an underrated area that will make the network more robust and versatile.

“As the chain begins to shift security to the Ethereum mainnet through solutions like EigenLayer, restaking could see a breakthrough.”

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…